Asia Pacific – where digital wallets battle for dominance

In this whitepaper, FYST outlines how Asia-Pacific’s consumers and merchants are the trailblazers for digital payment usage – and the significant shifts we can expect to see as this regional hotbed of innovation continues to break through infrastructure barriers.

FYST’s exclusive proprietary data, gathered across 12 countries (Australia, New Zealand, India, China, Japan, Thailand, South Korea, the Philippines, Bangladesh, Vietnam, Indonesia, and Malaysia) shines a light on the proportion of cards, bank transfers, digital wallets and other methods used for online purchases in each country. Crucially, we also outline which payment methods and card types are used in each country, demonstrating how important it is for merchants to be able to accept a wide array of locally-used payment methods to maximise transaction conversion rates and boost revenues.

The Asia-Pacific region is known as the birthplace of the digital wallet, and it’s become the dominant payment method for ecommerce across the continent, helped by the surging popularity of China’s WeChat Pay and Alipay across the region. In such an incredibly diverse landscape, with vastly differing payment habits and ecommerce usage evident from market to market, digital wallets represent nearly 70% of ecommerce transaction value across the region as a whole, and growth rates suggest no sign of slowing down.

And now, the region’s shoppers and sellers are benefitting from the launch of real-time and instant payment systems.

While ecommerce transactions across the region as a whole are still dominated by digital wallets and card payments, we can expect to see bank transfers and account-to-account (A2A) transactions taking a greater share of online purchases, with real-time payment infrastructure going live in more countries over the next few years. Given that bank transfers/A2A payments tend to be lower in cost than card payments, it will be interesting to revisit our data in the future to see just how big of a bite has been taken out of card volumes.

Given the dominance of WeChat Pay and Alipay, not just across the Asia-Pacific region, but their growing popularity across the world too, it’s simply not an option for merchants wherever they are located to ignore these two digital wallet giants.

Although credit cards remain popular, debit cards tend to be used more in mature economies like Australia and New Zealand, helped by adherence to international schemes and industry security mandates. The growing popularity of BNPL in online checkouts is evident in mature markets too, and Australia can justifiably claim to be the birthplace of BNPL given the proliferation of digital lenders there. In New Zealand, BNPL services are set to comprise around 17% of ecommerce expenditure by 2025.

The launch of India’s Unified Payments Interface (UPI) in 2016 shows how the introduction of real-time payment infrastructure is a game-changer for ecommerce payments, with consumers in India increasingly favouring bank transfers for online purchases. The Philippines’ InstaPay service and Indonesia’s BI-FAST system are set to spur usage of A2A transfers for ecommerce transactions.

For less mature ecommerce economies, cash-on-delivery remains a popular way to pay for online purchases, comprising around 90% of online transactions in some markets, but their share is expected to decline due to internet and mobile infrastructure improvements enable more consumers to transact through their phones.

In nascent ecommerce markets such as Bangladesh, we’re seeing how infrastructure improvements are helping to promote financial inclusion, which in turn generates economic growth. More than 2,500 online businesses were operating in Bangladesh as of 2021, with a growing number integrating accounts to accept credit card transactions.

These variances outlined in FYST’s whitepaper show how important it is for merchants to add localised payment methods, local currencies, and tailor payment acceptance strategies carefully to each market. By doing so, merchants can capture and convert more transactions, and reduce cart abandonment rates caused by consumers’ preferred payment method not being available.

Australia

Ecommerce market size in 2021: € 43.2 billion

Card - 49%

Bank transfer - 9%

Cash - 1%

Digital wallet - 26%

Other - 15%

Cards accepted: eftpos, Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, Discover, Diners Club, UnionPay, JCB, Paysafecard

Bank transfer services: POLI, 123, Osko, Sofort, open banking

Digital wallets: Apple, Google Wallet, Samsung Pay, PayPal, WeChat Pay, Alipay

BNPL: Afterpay, Bpay, ZIP, Post Billpay

Cash-on-delivery: Australian Post

- Australia’s ecommerce market is showing healthy growth of around 14% annually, supported by the growth of digital wallets, BNPL and trust in online bank transfers. BNPL is particularly popular with younger and millennial consumers.

- Over 9 million Australian households shopped online during 2022, an increase from 2021, with 84% of Australians shopping online regularly. Ecommerce comprised 6% of overall retail sales in 2021.

- The domestic debit card scheme eftpos is widely used alongside Visa and Mastercard for online transactions.

New Zealand

Ecommerce market size in 2021: € 5.3 billion

Card - 50%

Bank transfer - 15%

Cash - 1%

Digital wallet - 20%

Other - 14%

Cards accepted: eftpos, Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, Discover, Diners Club, UnionPay, JCB, Paysafecard

Transfer services: POLI, 123, Skrill

Digital wallets: Apple, Google Wallet, Samsung Pay, PayPal, WeChat Pay, Alipay

BNPL: Afterpay, ZIP

Cash-on-delivery: 123

- New Zealand’s ecommerce market is dominated by credit cards, which are increasingly being used in digital wallets.

- BNPL services are also growing quickly and are set to comprise around 17% of ecommerce expenditure by 2025.

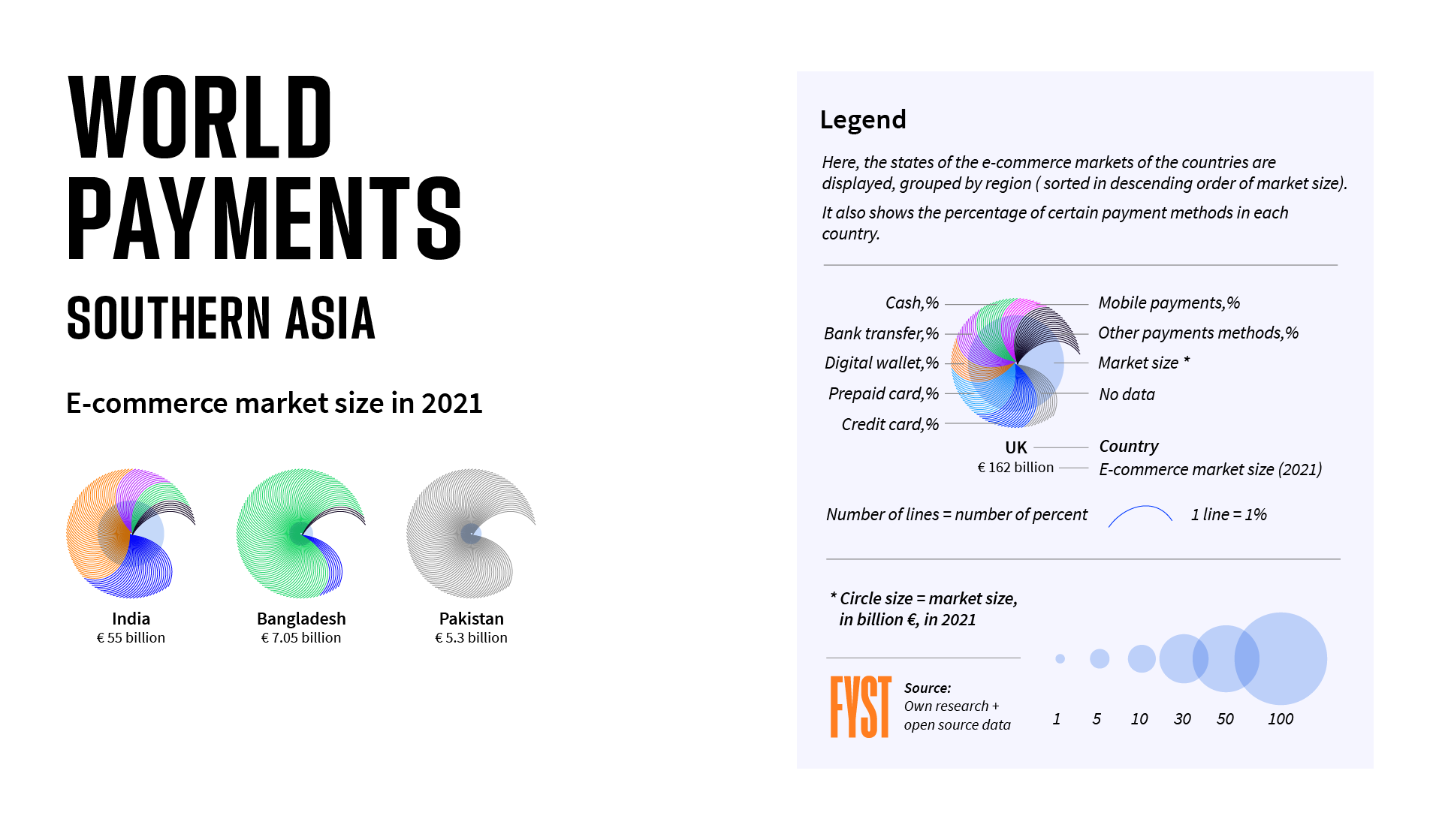

India

Ecommerce market size in 2021: € 55 billion

Card - 28%

Bank transfer - 12%

Cash - 9%

Digital wallet - 45%

Other - 6%

Cards accepted: J-Debit, Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, Discover, Diners Club, UnionPay, JCB, Paysafecard

Transfer services: UPI, Skrill, IMPS

Digital wallets: eZeeWallet, JioMoney, Paytm, PhonePe, Apple, Google Wallet, Samsung Pay, PayPal, WeChat Pay, Alipay, Neteller, AstroPay

Mobile carrier billing: Airtel, Freecharge, MobiKwik,

BNPL: Afterpay, ZIP

Cash-on-delivery: 123

- India’s ecommerce market has skyrocketed in the last few years, and is set to nearly double by 2025, with digital wallets leading the charge.

- Rapidly growing internet and smartphone penetration is driving more usage of ecommerce and digital payments, while the Unified Payments Interface is driving bank transfer payments for ecommerce.

- India’s online shopper base rose to around 190 million in 2021, with 50 million shoppers added in 2021 alone.

- As of 2022, around 25% of Indian consumers make at least one online purchase per week.

- The number of online shoppers in India is estimated to reach over 500 million by 2030.

Bangladesh

Ecommerce market size in 2021: € 7.05 billion

Cash-on-delivery - 90%

Card - 7%

Other - 3%

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, UnionPay, JCB, local bank cards

Transfer services: Boku, Mobiamo

Digital wallets: Apple Pay, Google Wallet, Samsung Pay, PayPal, WeChat Pay, Alipay, GrabPay, GPay, MyCash

Cash-on-delivery: bKash, Nagad, Rocket, UCash.

- More than 2,500 online businesses as of 2021, with a growing number integrating accounts to accept credit card transactions.

- Cash transactions are still the most widely used online financial transaction method for 90% of the Bangladeshi population.

- Bank transfer acceptance amongst merchants is minimal although gradually growing as the country’s internet and telecom infrastructure is improved.

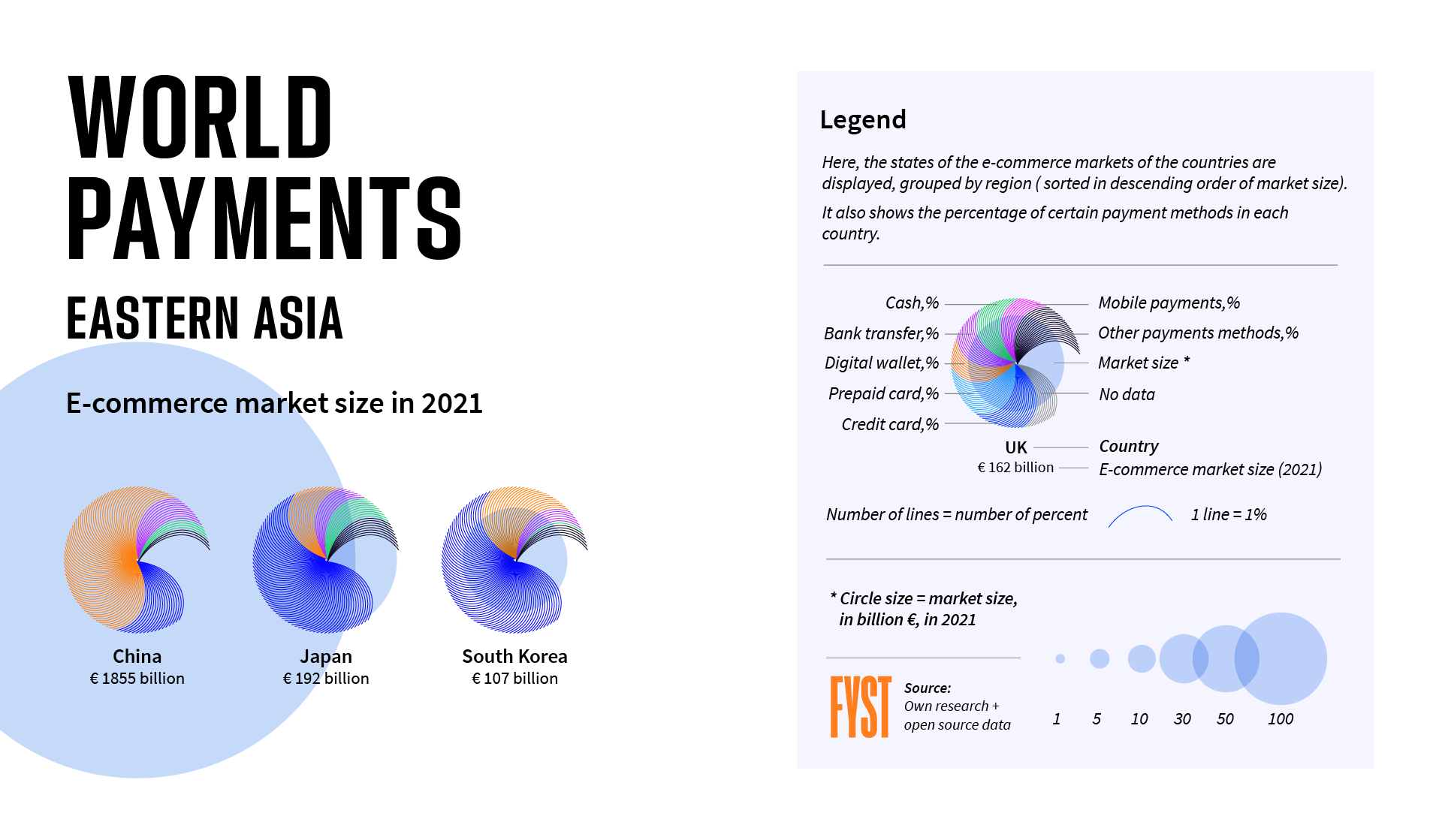

China

Ecommerce market size in 2021: € 1,855 billion

Card - 18%

Bank transfer - 10%

Cash - 4%

Digital wallet - 65%

Other - 3%

Cards accepted: UnionPay, Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, UnionPay, JCB, Diners Club, Discover

Transfer services: local bank transfers

Digital wallets: Apple Pay, Samsung Pay, PayPal, WeChat Pay, Alipay, GoPay, Baidu, Tenpay

Huawei Pay, JD Wallet

Mobile carrier billing: China Mobile

- China made up around half of global ecommerce retail sales in 2021, followed by the US and UK.

- Digital wallets have overtaken credit cards to become the favoured way to make ecommerce payments in China, comprising over 80% of transaction value in 2021.

- Native digital wallets WeChat Pay and Alipay are now widely accepted around the world.

- Ecommerce made up 10% of total retail sales in China in 2021, and double-digit growth is set to continue to 2025.

Japan

Ecommerce market size in 2021: € 192 billion

Card - 64%

Bank transfer - 7%

Cash - 9%

Digital wallet - 12%

Other - 8%

Cards accepted: J-Debit, Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, Discover, Diners Club, UnionPay, JCB, Paysafecard

Transfer services: Pay-easy

Digital wallets: Apple Pay, Google Wallet, Samsung Pay, PayPal, WeChat Pay, Alipay, Tigerpay, Venus Point, LINE Pay

Mobile carrier billing: SoftBank

BNPL: Afterpay, ZIP, Paidy

Cash-on-delivery: Konbini Payments, Pay-easy

- Japan might be a mature ecommerce economy but the appetite for online buying is only getting stronger each year with growth rates ranging by around 10% to 2025.

- JCB is the most widely used payment card by Japanese consumers, ahead of Visa and Mastercard, while digital wallets and BNPL are set to take away market share from cash-on-delivery over the next few years.

- In 2021, ecommerce sales made up 11% of total retail sales in Japan, with mobile commerce making up 32% of ecommerce expenditure.

South Korea

Ecommerce market size in 2021: € 107 billion

Card - 66%

Bank transfer - 6%

Cash - 1%

Digital wallet - 22%

Other - 5%

Cards accepted: T-money, Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, Discover, Diners Club, UnionPay, JCB, local bank cards,

Transfer services: Local bank transfers

Digital wallets: Apple Pay, Google Wallet, Samsung Pay, PayPal, WeChat Pay, Alipay, GrabPay, KakaoPay, NaverPay, Toss Pay, Payco, L.Pay,

Prepaid vouchers accepted: Cashbee, Culture Voucher, EggMoney, Happy Voucher, OnCash, Teencash

Mobile carrier billing: SK Telecom, KT, LG Uplus

- Online shopping hit a record high in 2021, up 20% from 2020.

- Cards continue to dominate ecommerce spending in South Korea, although digital wallets and super apps are now taking a big bite out of card volumes. Digital wallets comprised around 20% of ecommerce expenditure in 2021 and are set to take 30% markets share by 2025.

- In 2021, ecommerce sales comprised 25% of overall sales, and mobile commerce took 70% of overall ecommerce spend.

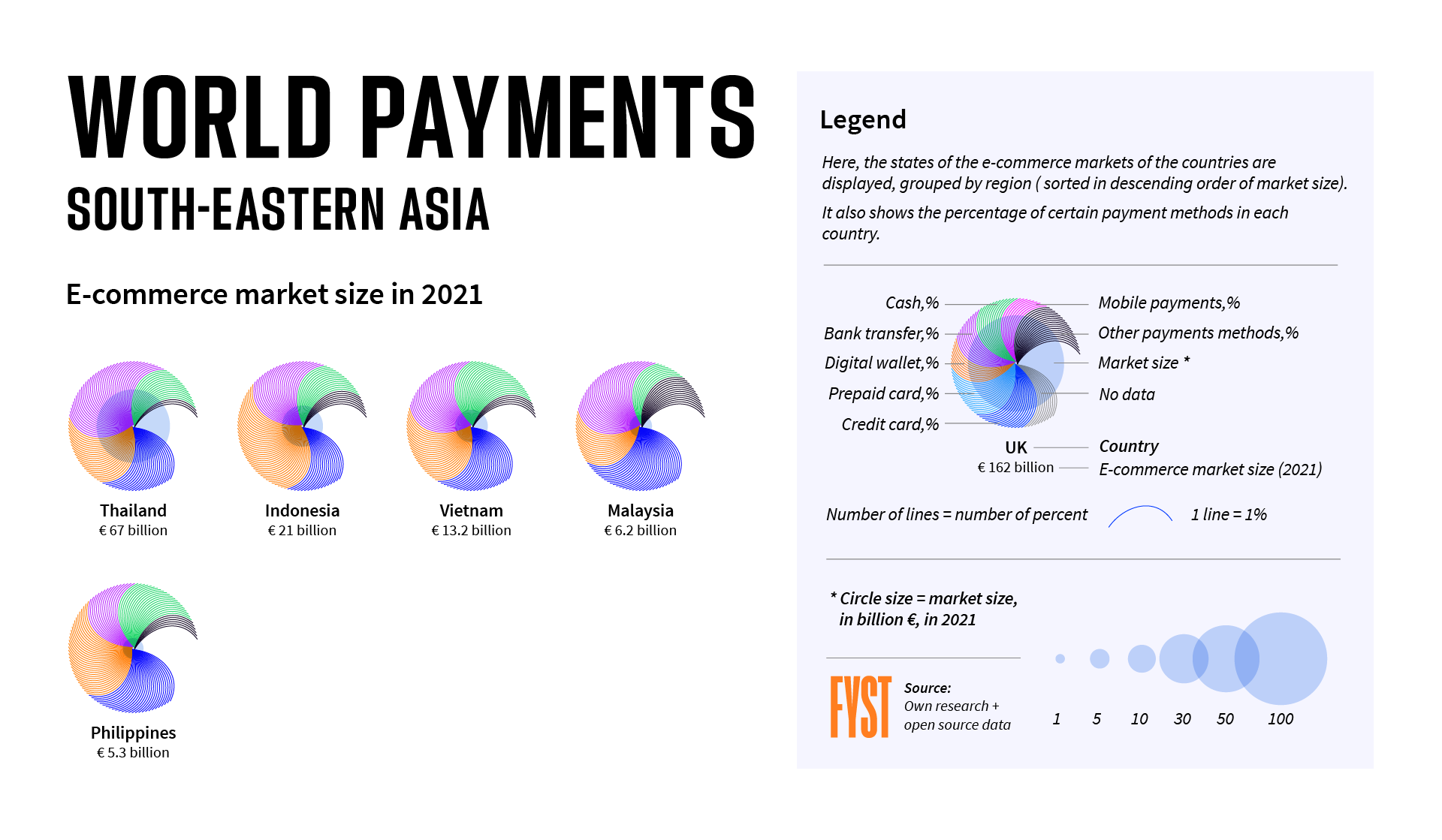

Thailand

Ecommerce market size in 2021: € 67 billion

Card - 22%

Bank transfer - 37%

Cash - 15%

Digital wallet - 23%

Other - 3%

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, Discover, Diners Club, UnionPay, JCB

Transfer services: Thai QR Payments, PromptPay

Digital wallets: Apple Pay, Google Wallet, Samsung Pay, PayPal, WeChat Pay, Alipay, GrabPay, TrueMoney, Rabbit LINE Pay

- In contrast to the rest of the Asia-Pacific region where cards and digital wallets dominate ecommerce, banks transfers are overwhelmingly the most popular form of online payment method in Thailand.

- In 2021, ecommerce comprised 23% of overall retail sales in Thailand, with mobile commerce forming 62% of all ecommerce sales.

- With around 40 million ecommerce buyers, over half of Thai online shoppers make at least one online purchase per month.

Indonesia

Ecommerce market size in 2021: € 21 billion

Card - 17%

Bank transfer - 23%

Cash - 14%

Digital wallet - 39%

Other - 7%

Cards accepted: GPN, Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, UnionPay, JCB

Transfer services: BCAKlik Pay, e-PayBRI, Jokul, Mandiri Clickpay

Digital wallets: Samsung Pay, PayPal, WeChat Pay, Alipay, GrabPay, Doku Wallet, GoPay, Sakuku, Jenius, OVO, LinePay, KasPay, Gojek

Mobile carrier billing: Telkomsel, Indosat, BTel, XL Axiata, 3 Indonesia

Cash-on-delivery: Indomaret

BNPL: Kredivo, Alfamidi

- Indonesia is one of the world’s fastest growing e-commerce markets, and despite popular wallets like Apple Pay and Google Wallet not being present in the country, the widespread usage of super apps like GrabPay have been instrumental in capturing consumer imagination and generating trust in digital wallets.

- Bank transfers, cash-on-delivery, credit cards and debit cards remain commonly used online payment methods but are rapidly losing ground to apps and digital wallets. GPN is the national debit card scheme.

- The launch of Indonesia’s instant payments service BI-FAST will spur usage of transfers for ecommerce transactions.

Vietnam

Ecommerce market size in 2021: € 13.2 billion

Card - 23%

Bank transfer - 24%

Cash - 23%

Digital wallet - 25%

Other - 5%

Cards accepted: NAPAS, Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, UnionPay, JCB

Transfer services: EeziePay, VaderPay, JusPay, EcoPayz, Payoo, VNPay

Digital wallets: Apple Pay, Google Wallet, Samsung Pay, PayPal, WeChat Pay, Alipay, GrabPay, BaoKim, AirPay, MoMo, ViettelPay, Nganluong, mPAYvn, VTC Pay, ZaloPay

Cash-on-delivery: 123

- Vietnam is quite unusual in the Asia-Pacific region in that ecommerce expenditure is spread evenly across cards, digital wallets, bank transfers and cash-on-delivery. Vietnamese consumers are spoilt for choice in the number of international and local digital wallets, which can be integrated with cards.

- Visa and Mastercard cards are accepted for online transactions and the domestic NAPAS scheme supports payments through mobile wallets, at physical locations and online.

- As of 2021, ecommerce spending comprised around 10% of all sales in Vietnam, with mobile commerce forming over 60% of ecommerce expenditure.

Malaysia

Ecommerce market size in 2021: € 6.2 billion

Card - 31%

Bank transfer - 30%

Cash - 9%

Digital wallet - 16%

Other - 14%

Cards accepted: MyDebit, MyCard, UnionPay, Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, UnionPay, JCB, Diners Club, Discover

Transfer services: local bank transfers, FPX, DuitNow, BSN, i-Muamalat

Digital wallets: Apple Pay, Samsung Pay, PayPal, WeChat Pay, Alipay, GrabPay, Boost, FavePay, RazerPay, ShopeePay

Mobile carrier billing: China Mobile

BNPL: JomPay

Cash voucher: 123

- Malaysia stands out in the Asia-Pacific region due to the popularity of bank transfers, which comprise around 30% of market share, while BNPL usage is growing and is set to form more than 10% of ecommerce expenditure over the next few years.

- In 2021, ecommerce sales comprised around 5% of total retail sales in Malaysia. There were 22 million digital-native consumers in Malaysia in 2021.

- Around 90% of Malaysian consumers made at least one online purchase in the previous six months.

- In 2021, over 500,000 businesses sold goods or services online.

Philippines

Ecommerce market size in 2021: € 5.3 billion

Card - 27%

Bank transfer - 14%

Cash - 21%

Digital wallet - 31%

Other - 7%

Cards accepted: BancNet, Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, Discover, Diners Club, UnionPay, JCB, local bank cards,

Transfer services: PesoPay, ShopeePay, InstaPay

Digital wallets: Apple Pay, Google Wallet, Samsung Pay, PayPal, WeChat Pay, Alipay, GrabPay, Smart Money, PayMaya, DragonPay, GCash

Cash-on-delivery: 123, ML ePay, TrueMoney

Mobile carrier billing: SK Telecom, KT, LG Uplus

- Despite being a small ecommerce market in the region, the launch of instant payments through the InstaPay service has led to a surge in bank transfers for ecommerce transactions.

- Digital wallets dominate ecommerce in the Philippines, overtaking cards in 2021 in terms of transaction value.

- In 2021, only 2% of retail sales came from ecommerce but this figure is set to rise sharply over the next few years, particularly as mobile commerce forms a greater share of overall ecommerce transactions (over 60%).

Conclusion – the importance of localising payments by market

What’s most important for merchants when they’re trying to grow? Is it offering the widest product range at the lowest prices? Or having the most eye-catching advertising campaign? Merchants often forget to put themselves in their customers’ shoes, especially those entering the site for the first time. What do customer see? How easy is it for them to find what they’re looking for? And can they pay in the way they want to pay?

The global ecommerce landscape is getting more crowded and brutally competitive, and consumers are more impatient and demanding than ever before. The breakneck pace of payment technology innovation is putting even more pressure on merchants to offer their customers even quicker and easier payment journeys. It’s easy to forget just how much work goes on behind the scenes to get a fast checkout process in place – and the challenges of slashing the dreaded cart abandonment rate are even harder when trying to sell to international customers.

In summary:

- Adding localised payment methods, local currencies and optimising the payment funnel are no-brainers when trying to grow cross-border ecommerce sales. Putting these in place will undoubtedly help to attract customers and raise checkout conversions.

- As cross-border payments get more complex, it’s not just consumers who need payments to be made as simple as possible at the checkout stage. Merchants too need to have payment gateways and platforms that are easy to use and simple for them to navigate, so they can give their customers the best experience possible.

- Merchants are becoming fed up with having to work with multiple acquirers and platforms for different types of transactions or services. Merchants want everything run through a single, easy to use platform, enabling them to accept localised payment methods, offering a transparent view of all data.

- Unified payment gateways deliver all the things merchants need - a simplified, faster, and smoother buying experience for customers on all devices, localised currency and language support, plug-and-play and API integrations, and deep data analytics functionality to aid marketing strategies and checkout conversions.

All of these elements give merchants the 360-degree overview of customer behaviour they need to fine-tune their businesses, strengthen their revenue streams, and reach far into new markets and customer bases.

At FYST, we have one clear mission - by removing geographical limitations and simplifying complex processes, we enable businesses in all sectors to navigate the fast-growing cross-border ecommerce market.

Simply put, FYST is a one-stop payments consultancy for ecommerce businesses, empowering merchants with a unique mix of agile digital payments capabilities, unrivalled personalised support, and compliance and AML advisory services.

Our fresh, creative approach to solving long-standing, business-limiting problems is a breath of fresh air in the payments space. We have created a diverse team of successful industry pioneers who not only understand the importance of payments, but how to put people and intuitive UX at the heart of business growth.

We’re not reinventing the wheel – we’re reimagining money to help our merchants move it easier, earn it faster, and make it flex in new ways.

If you want to find out how to optimise your online presence and unlock game-changing payment method acceptance, contact FYST today.