Europe

In this whitepaper, FYST untangles the many ecommerce strands that make up Europe’s digital payments patterns. What’s evident is that the continent’s digital economy is dynamic, growing swiftly thanks to the pandemic-driven shift to online payments, yet still diverges on national lines in some respects.

It’s important to remember that Europe is not a homogenous mass – there are clear distinctions between countries in how consumers and business make online payments. For example, the proportion of individuals using the internet for ordering goods or services swings from a high 92% in the UK down to a low of 38% in Romania.

And there are differences between those European countries in the European Union, those in the eurozone, and those in the European Economic Area. Harmonised legislation like PSD2 has helped European Union member countries adapt to shared payment instruments like SEPA credit transfers and there is widespread usage of international schemes like Visa and Mastercard, but the eastern-facing nations like Belarus and Kazakhstan are more closely aligned with Russian payment methods and schemes like MIR. Although the number of national-only schemes is gradually dwindling in favour of internationally accepted schemes, there is still a lack of interoperability across many markets which limits the adoption of popular payment methods used elsewhere.

- Ecommerce shoppers in Germany, the Netherlands, Poland, Switzerland and Lithuania overwhelmingly favour bank transfers ahead of cards, thanks to long-established and trusted credit transfer schemes which have been optimised for mobile usage too.

- In Italy, digital wallets have overtaken cards as the most popular online payment method.

- In Kazakhstan, almost a fifth of online retail in 2021 was done via mobile phones, while in Azerbaijan, mobile payments comprise around 60% of online transactions.

The outbreak of conflict between Russia and Ukraine in February 2022 meant that international sanctions were imposed on Russian-owned banks, remittance companies and other payments firms. This led to Visa and Mastercard suspending the processing of Russian-issued card transactions outside of Russia, restricting their usage to within Russia’s borders only. Consequently, the domestic card scheme MIR surged in usage as Russian consumers looked for alternatives to Visa, Mastercard and other methods for cross-border online transactions.

These recent events show that in many eastern European markets, domestic schemes still hold considerable sway over ecommerce preferences, backed by government efforts to promote alternatives to western operators. Nuances like these show the necessity for merchants who want to sell in these markets to tailor their online checkouts to reflect fast-changing consumer preferences.

On a broader scale, the emergence of Open Banking, IBAN account-to-account (A2A) payments and real-time settlement systems is having a profound impact on how consumers and businesses across Europe make payments, and in many cases these new payment types are directly competing with cards. It’s no longer enough for merchants to accept Visa, Mastercard or methods favoured in their home country. Increasingly, they will need to be cross-border in nature and accept the super apps like We Chat Pay, instant A2A payments, and other cardless instruments like BNPL if they are to attract and retain customers.

An important development for merchants to be mindful of is that from July 2023, European banks and card issuers will no longer issue Maestro cards and will replace them with Debit Mastercards, while Visa will phase out Visa Electron cards from 2024 and replace them with Visa Debit cards. Neither Maestro nor Electron are configured for modern ecommerce and cannot be used for online or in-app payments, necessitating the switch to Debit Mastercard and Visa Debit. While western European issuers have largely completed their portfolio migrations to the new debit card formats, those in eastern Europe have yet to catch up, which may slow down the rate of online spending in some markets.

These variances outlined in FYST’s whitepaper show how important it is for merchants to add localised payment methods, local currencies, and tailor payment acceptance strategies carefully to each market. By doing so, merchants can capture and convert more transactions, and reduce cart abandonment rates caused by consumers’ preferred payment method not being available.

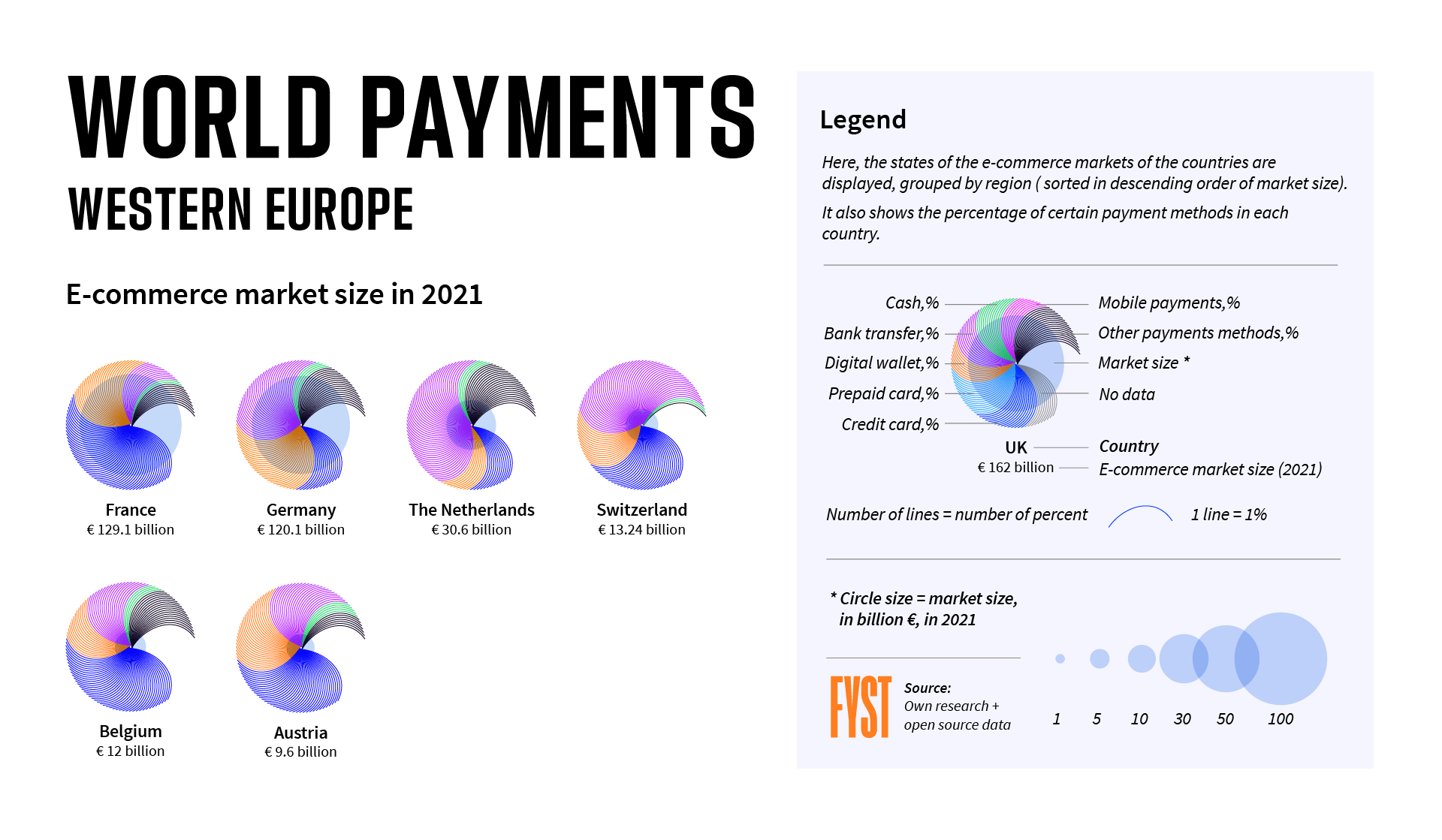

France

Ecommerce market size in 2021: €129.1 billion

Card - 52%

Bank transfer - 11%

Cash - 2%

Digital wallet - 25%

Other - 10%

Cards accepted: Cartes Bancaires, Mastercard, Visa, Debit Mastercard, Visa Debit, V PAY, American Express, Diners Club, JCB, Discover, UnionPay, e.carte bleue, Paysafecard

Bank transfers: Trustly, Sofort

Digital wallets: Apple Pay, Google Wallet, WeChat Pay, Alipay, Samsung Pay, Paylib

Cash-on-delivery: Paysafecash, Cashway

- Cartes Bancaires cards are preferred by French online buyers, and comprised more than 90% of all online payments in 2021. Cartes Bancaires cards can be co-branded with Visa or Mastercard, are accepted online and are PCI-DSS compliant, allowing them to be used in cross-border ecommerce.

- The Paylib app is a digital wallet offered by several French banks as a mobile app or integrated with online banking portals. Paylib had over 25 million registered users as of 2022.

Germany

Ecommerce market size in 2021: €120.1 billion

Card - 14%

Bank transfer - 34%

Cash - 4%

Digital wallet - 29%

Other - 19%

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, V PAY, girocard, American Express, Diners Club, JCB, UnionPay, Discover, ELV, AirPlus, Paysafecard

Bank transfers: Sofort, Giropay, Trustly, Ecopayz

Digital wallets: Apple Pay, Google Wallet, Samsung Pay, WeChat Pay, Alipay, Mifinity, PayPal

- Although growing in usage, cards face stiff competition from direct bank transfers, which are heavily used, helped by long-established online banking infrastructure.

- giropay and Sofort are widely accepted by German businesses.

- Around 45% of domestic online transactions are made with digital wallets, with PayPal being the most popular brand.

The Netherlands

Ecommerce market size in 2021: €30.6 billion

Card - 13%

Bank transfer - 52%

Cash - 4%

Digital wallet - 9%

Other - 22%

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, V PAY, Diners Club, Discover, UnionPay, Bancontact, American Express, JCB

Bank transfers: iDeal, Sofort, Trustly, Skrill, Rapid, PayByBank, Handelsbanken, SafetyPay

Digital wallets: Paysera, Payconiq, Apple Pay, Google Wallet

BNPL: Billink, Afterpay

Mobile carrier billing: Mobiamo Boku

Cash-on-delivery: Paysafecash

- Credit cards have not grown as strongly in the Netherlands as debit cards due to a long-standing cultural Dutch aversion to revolving credit.

- The domestic A2A scheme iDEAL leads the way in online and mobile bank transfers, with its market share in ecommerce growing to 70% in 2021, from 69% in 2020. It’s accepted by around 200,000 merchants.

Switzerland

Ecommerce market size in 2021: €13.24 billion

Card - 30%

Bank transfer - 50%

Cash - 2%

Digital wallet - 17%

Other - 1%

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, V PAY, American Express, JCB, UnionPay, Diners Club, Discover, PostFinance, girocard, Paysafecard, MyOne

Bank transfers: Postfinance, Trustly

Digital wallets: TWINT, Apple Pay, Google Wallet, Samsung Pay, PayPal, WeChat Pay, Alipay

Mobile carrier billing: Boku, DaoPay, Mobiamo

Crypto wallet: Oxygen

- The domestic TWINT mobile payment scheme is the most widely used mobile payment solution in Switzerland. More than 60% of ecommerce spend with mobile devices were made with TWINT in 2021. Apple Pay is the second most-used mobile payment solution, comprising 9% of spend, with Samsung Pay (4%) and Google Pay (2%) bringing up the rear.

- In 2021, Switzerland was one of the top five e-commerce markets in Europe, with six million online shoppers. Around 61% of online purchases made in Switzerland were cross-border purchases.

Belgium

Ecommerce market size in 2021: €12.0 billion

Card - 45%

Bank transfer - 19%

Cash - 4%

Digital wallet - 14%

Other - 18%

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, V PAY, Bancontact, American Express, Diners Club, JCB, Discover, UnionPay, Aurora, Paysafecard, Astropay

Bank transfers: Neteller, Sofort, iDeal, Bancontact, MyBank, Rapid Transfer, ING HomePay, Trustly, KBC Touch

Digital wallets: Skrill, Bancontact, Payconiq, PayPal, Apple Pay, Google Wallet, Samsung Pay, WeChat Pay, Alipay, Satispay

Cash-on-delivery: Mister Cash, Cashlib

- Belgium’s high card penetration numbers and widespread online banking infrastructure has helped to drive up mobile payment and digital wallet usage over the last few years.

- Belgian mobile banking apps offering immediate transfer services in Belgium include Bancontact Payconiq, and PayPal. In 2021 204 million transactions were made using Payconiq’s app, up 62% from 2020.

- Most Belgian banks offer online bank credit transfer services like MyBank and iDEAL, and IBAN-based online payments integrated in mobile banking apps, the Payconiq app, and MyBank. Other online credit transfer services include SOFORT.

Austria

Ecommerce market size in 2021: €9.60 billion

Card - 39%

Bank transfer - 23%

Cash - 5%

Digital wallet - 26%

Other - 7%

Cards accepted: Airplus, UATP, Mastercard, Visa, Debit Mastercard, Visa Debit, V PAY, American Express, Diners Club, JCB, Discover, UnionPay, Paysafecard

Bank transfers: EPS, Sofort, Trustly, Neosurf

Digital wallets: Apple Pay, Google Wallet, Mifinity, Skrill, Samsung Pay, WeChat Pay, Alipay, Muchbetter

- With high bank account penetration, Austrian consumers are comfortable using online bank transfers for payments. EPS is the domestic IBAN-based A2A payment service that’s used for online shopping.

- In 2021, more than 806 million A2A transactions worth almost €1,419 billion were made, formed of 752 million clearing service transactions (transfers and collection orders), 54 million EPS online transfers and 0.4 million instant payment transactions.

- Several Austrian banks issue prepaid cards and virtual cards for online use. paysafecard, an Austrian prepaid provider, issues the prepaid paysafecard in Austria and globally.

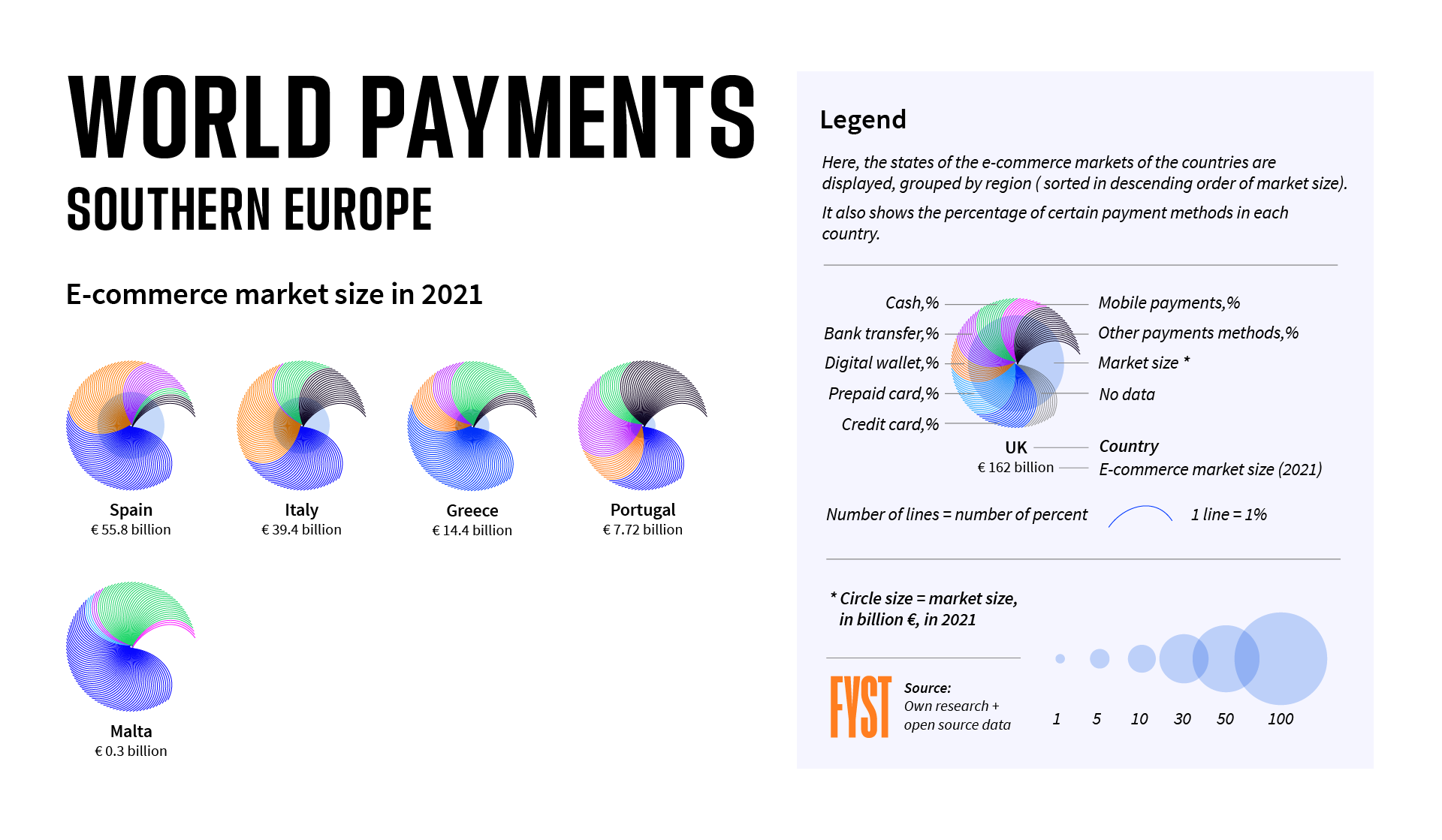

Spain

Ecommerce market size in 2021: €55.80 billion

Card - 47%

Bank transfer - 15%

Cash - 3%

Digital wallet - 30%

Other - 5%

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, V PAY, American Express, JCB, Discover, UnionPay, Diners Club, Paysafecard

Bank transfers: Trustly,

Digital wallets: Bizum, Apple Pay, Google Wallet, Samsung Pay, PayPal, WeChat Pay, Alipay

Cash-on-delivery: Teleingreso, Paysafecash

BNPL: Klarna

- Around 90% of Spanish cross-border e-commerce was conducted with other EU countries in 2021. Mobile ecommerce spending was €21.9 billion and is set to form a much bigger proportion of overall ecommerce spending in the coming years.

- Bizum enables instant mobile-enabled bank account transfers, including for online purchases. In 2021, Bizum had over 21.5 million registered users and is accepted at over 31,000 establishments in Spain.

- Teleingreso is a bank transfer service that allows consumers to make payments via ATMs, post offices and selected retail outlets throughout Spain.

Italy

Ecommerce market size in 2021: €39.4 billion

Card - 32%

Bank transfer - 11%

Cash - 14%

Digital wallet - 34%

Other - 9%

Cards accepted: NEXI, PagoBancomat, Mastercard, Visa, Debit Mastercard, Visa Debit, V PAY, American Express, Diners Club, JCB, Discover, UnionPay, Paysafecard, Mooney

Bank transfers: MyBank, Neteller

Digital wallets: MyBank, MySi, Postepay, NEXI, Skrill, Satispay, Apple Pay, Google Wallet, WeChat Pay, Alipay, Samsung Pay, PayPal

BNPL: Clearpay

Cash-on-delivery: Paysafecash

- Bancomat Pay, the instant A2A payments app, allows 37 million PagoBancomat cardholders to pay online and make ecommerce purchases.

- According to Italy’s central bank, for online purchases in 2021, the most used instruments were cards (54.4% and 59.0%, in volume and value, respectively) and digital wallet PayPal (27.2% and 22.6%, in volume and value, respectively).

- All Italian banks issue debit and credit cards co-branded with Mastercard or Visa. Domestic card schemes include Bancomat, PagoBancomat, and NEXI. Domestic cards are processed in Italy according to the domestic brand and are independent from the co-badged international brand.

Greece

Ecommerce market size in 2021: €14.40 billion

Card - 49%

Bank transfer - 9%

Cash - 24%

Digital wallet - 12%

Other - 6%

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, V PAY, American Express, Diners Club, JCB, Discover, UnionPay

Bank transfers: Trustly, Wise, Skrill, Rapid Transfer

Digital wallets: Apple Pay, Google Wallet, PayPal, Skrill, Vivawallet, WeChat Pay, Alipay

Cash-on-delivery: Taxydromiki, Ekdochi

- As one of Europe’s under-penetrated online markets and more cash-heavy markets, just 15% of Greek enterprises (about 8,000) had an online presence in 2020.

- Following the pandemic, online card transactions increased by nearly 120% in 2021, helped by the government giving €5,000 handouts to Greek businesses to help them get online, increasing the number of online merchants by 30% in 2021.

Portugal

Ecommerce market size in 2021: €7.72 billion

Card - 23%

Bank transfer - 24%

Cash - 10%

Digital wallet - 12%

Other - 31%

Cards accepted: Multibanco (MB), Mastercard, Visa, Debit Mastercard, Visa Debit, V PAY, American Express, Diners Club, JCB, Discover, UnionPay, Paysafecard

Bank transfers: MultiBanco, IberCaja Pay, Payshop, Neteller, Rapid Transfer, Neosurf, ecoPayz

Digital wallets: MBWay, Apple Pay, Google Wallet, Samsung Pay, WeChat Pay, Alipay, Lydia, MEO, Skrill, eZeeWallet, Mifiniti, PayPal

- MBWay enables payments from around 30 banks in Portugal, allowing users to connect their bank cards with their mobile number to make instant bank transfers. Cardholders can also use the MBWay app to generate virtual cards for online purchases on any website that accepts payments by American Express, Mastercard or VISA. In 2021, MBWay had more than 3.8 million users, rising by more than 20% from 2020.

- In 2021, online purchases with domestic cards were mostly made with foreign merchants. Transactions with foreign merchants comprised 65% of volume and 66% of total online expenditure.

Malta

Ecommerce market size in 2021: €0.30 billion

Credit card - 58%

Prepaid card - 3%

Mobile carrier billing - 3%

Bank transfer - 3%

Digital wallet - 33%

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, JCB, UnionPay, Diners Club, Discover, Paysafecard

Bank transfers: Trustly

Digital wallets: PaySera, PayPal, Apple Pay, Google Wallet, WeChat Pay, Alipay

Mobile carrier billing: Boku, Mobiamo

- Malta is one of the world's smallest ecommerce markets but is quickly adopting mobile payment solutions, and it was the first country in the world to recognise crypto currencies legally, enabling crypto payment solutions to gain traction.

- In 2021, 90% of Maltese online buyers purchased from neighbouring EU countries.

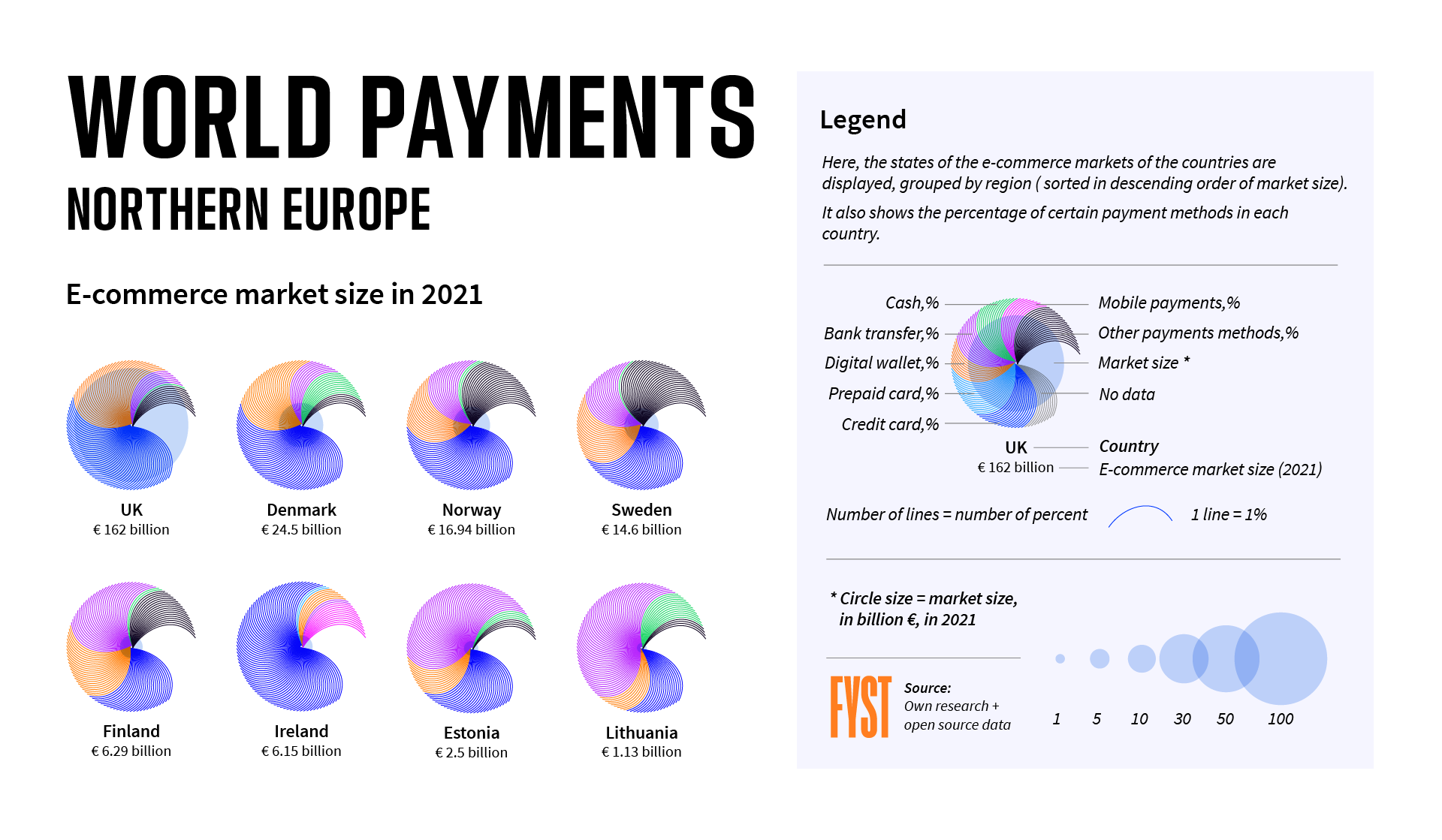

UK

Ecommerce market size in 2021: €162.0 billion

Card - 51%

Bank transfer - 7%

Cash - 1%

Digital wallet - 32%

Other - 9%

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, V PAY, American Express, Diners Club, JCB, Discover, UnionPay, Solo, Laser, Paysafecard

Bank transfers: PayByBank, open banking, Revolut

Digital wallets: Apple Pay, Google Wallet, Samsung Pay, PayPal, WeChat Pay, Alipay

- The UK comprised 23% of total European B2C ecommerce expenditure, and ecommerce sales formed almost 30% of total retail sales. Overall, ecommerce amounted to 6.19% of UK GDP in 2021.

- The UK is also Europe’s largest mobile commerce market, with 43% of online sales conducted through smartphones and and other mobile devices like tablets.

- The UK’s payment landscape is being reshaped by strong growth in mobile banking, increased use of Open Banking and A2A payments. By 2021, around 27 million Open Banking payments had been made, growing by more than 500% from 2020.

Denmark

Ecommerce market size in 2021: €24.50 billion

Card - 49%

Bank transfer - 9%

Cash - 11%

Digital wallet - 26%

Other - 5%

Cards accepted: Dankort, Mastercard, Visa, Debit Mastercard, Visa Debit, V PAY, American Express, JCB, Discover, UnionPay, Eurocard, Paysafecard, ecoPayz, Cashlib

Bank transfers: Trustly, eDankort, Handelsbanken, Sofort, Neteller

Digital wallets: MobilePay, Apple Pay, Google Wallet, Samsung Pay, PayPal, Skrill, WeChat Pay, Alipay

- The national debit card scheme Dankort can be co-branded with international scheme Visa to enable international acceptance. Dankort and Visa Dankort are the most popular cards used for 30% of ecommerce purchases, followed by international cards.

- Denmark has the largest number of online shoppers in the whole of the European Union. Ecommerce accounted for about 30% of total card turnover in Denmark, and cross-border transactions account for nearly a quarter of total ecommerce.

- The MobilePay mobile wallet has the highest usage of mobile bank apps in Denmark. The number of users who shop online with MobilePay has grown to over 3.4 million. The total number of stores and online locations accepting MobilePay rose to almost 207,000 in 2021.

Norway

Ecommerce market size in 2021: €16.94 billion

Card - 42%

Bank transfer - 15%

Cash - 2%

Digital wallet - 17%

Other - 24%

Cards accepted: BankAxept, Mastercard, Visa, Debit Mastercard, Visa Debit, V PAY, American Express, JCB, Diners Club, Discover, UnionPay, ecoPayz, Paysafecard

Bank transfers: Trustly, Handelsbanken, Neteller

Digital wallets: Vipps, Neosurf, Skrill, Mifinity, Astropay, Apple Pay, Google Wallet, Samsung Pay, PayPal, WeChat Pay, Alipay

- In 2021, around 5 million Norwegians shopped online, representing 93% of the population, with nearly 80% making cross-border online purchases. Payments to Norwegian online shops accounted for over 60% of all payments for online shopping.

- Most debit cards in Norway are branded with the domestic scheme BankAxept, Mastercard or Visa. The most widely used card type combines BankAxept with either Visa or Mastercard, which make up nearly 60% of all cards issued in Norway.

- The Norwegian mobile payment service Vipps had around 4.1 million users in 2021, with 98% of users active every month.

Sweden

Ecommerce market size in 2021: €14.60 billion

Card - 32%

Bank transfer - 17%

Cash - 1%

Digital wallet - 20%

Other - 30%

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, V PAY, American Express, JCB, Diners Club, Discover, UnionPay, Paysafecard

Bank transfers: Trustly (bank transfer), Nordea (bank transfer), Alandsbanken (bank transfer), Handelsbanken (bank transfer), Neteller, Swish

Digital wallets: Zimpler (wallet), Swish (wallet), Skrill, Muchbetter, Mifinity, Apple Pay, Google Wallet, Samsung Pay, PayPal, WeChat Pay, Alipay

Mobile carrier billing: Siru Mobile

BNPL: Paylevo

- Swedish debit cards can be badged with Debit Mastercard or Visa Debit.

- Digital A2A payment services like Swish are also widely used. By 2021 Swish had 8.4 million users, and claimed to be the preferred method for online payments by Swedes aged 18-40. In 2021, there were around 791 million Swish payments, up by nearly 50% on 2020, for total value of more than SEK 395 billion.

- In 2021, 92% of Swedish online shoppers bought online from Swedish sellers, while 32% bought from EU countries, and 19% from the rest of the world.

Finland

Ecommerce market size in 2021: €6.29 billion

Card - 26%

Bank transfer - 31%

Cash - 2%

Digital wallet - 23%

Other - 18%

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, V PAY, American Express, JCB, Diners Club, Discover, UnionPay, Eurocard, Paysafecard

Bank transfers: Trustly, Siirto, Alandsbanken, Danske Bank, Handelsbanken, Oma Säästöpankki, OP-mobiili, POP Pankki, Sofort, Euteller, Neteller

Digital wallets: MobilePay, Aktia, Zimpler, Skrill, Mifinity, MuchBetter, ePassi, Pivo, Apple Pay, Google Wallet, Samsung Pay, WeChat Pay, Alipay

- As of 2021, ePassi had more than 1.9 million users and was accepted by 50,000 merchants.

- In 2021, Finland was the most mature digital economy in the EU with an avid online shopping population, with 28% of Finnish consumers increasing their use of online shopping during the year.

- Remote card payments continued to gain ground in 2021, according to the Bank of Finland. A total of 221 million card payments were initiated on a computer or mobile device.

Ireland

Ecommerce market size in 2021: €6.15 billion

Credit card - 79%

Prepaid card - 2%

Mobile payment - 11%

Bank transfer - 2%

Digital wallet - 6%

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, V PAY, American Express, JCB, Discover, UnionPay, Diners Club, Paysafecard

Bank transfers: Paysera, Trustly

Digital wallets: PayPal, Apple Pay, Google Wallet, Samsung Pay, Lydia, WeChat Pay, Alipay

Mobile carrier billing: Boku, Mobiamo

- Mobile payment services like Apple Pay and Google Pay are growing in usage, although Irish banks have teamed up to launch their own scheme named Synch Payments.

- According to Irish retail data, ecommerce sales as a percentage of total retail sales increased to 15.3% by 2020, with estimates showing that between 50% and 70% of online sales in Ireland are cross-border.

- Irish consumers use cards to pay for 60% of online purchases, while digital wallets are set to comprise 22% of the overall payments market by 2023. In 2021, online shopping via smartphones comprised 54% of the traffic on Irish websites and accounted for 45% of total online sales.

Estonia

Ecommerce market size in 2021: €2.50 billion (up 47% from 2020)

Card - 28%

Bank transfer - 52%

Cash - 4%

Digital wallet - 12%

Other - 4%

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, V PAY, American Express, JCB, Diners Club, Discover, UnionPay, Paysafecard

Bank transfers: Luminor, Coop Pank, LHV, Swedbank, Trustly

Digital wallets: YooMoney, WebMoney, PayPal, Paysera, Apple Pay, Google Wallet, WeChat Pay, Alipay

Mobile carrier billing: Boku, Mobiamo

- In 2021 there were around 5,000 online shops in Estonia, while 58% of all ecommerce spending was made in Estonian online stores.

- According to Estonia’s central bank, the most common ways of buying online in Estonia is through bank link payment orders and Open Banking-enabled payment initiation services.

- Although instalments and services like BNPL are used less frequently, they are gradually growing in popularity.

Lithuania

Ecommerce market size in 2021: €1.13 billion

Card - 17%

Bank transfer - 57%

Cash - 13%

Digital wallet - 9%

Other - 4%

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, V PAY, American Express, JCB, UnionPay, Diners Club, Discover, Neosurf

Bank transfers: i-Unija, Medicinos Bankas, Swedenbank, Trustly, Luminor, Neteller

Digital wallets: Skrill, MobilePay, Skrill, Mifinity, Apple Pay, Google Wallet, Samsung Pay, PayPal, WeChat Pay, Alipay

Cash-on-delivery: Paypost, Perlas, Maxima

Crypto: Bitpace, SmartCashew, Piastrix

- Lithuania is one of Europe’s smaller but more advanced ecommerce markets. In 2021 60% of Lithuanians used ecommerce for personal purchases in the previous 12 months.

- The combined impact of the 2020 COVID-19 pandemic, plus card portfolio migration from the UK following Brexit, led to a 386% increase in online card payments in Lithuania in 2021.

- In 2015, for the first time, debit cards were used more often for online payments than credit cards and virtual credit cards.

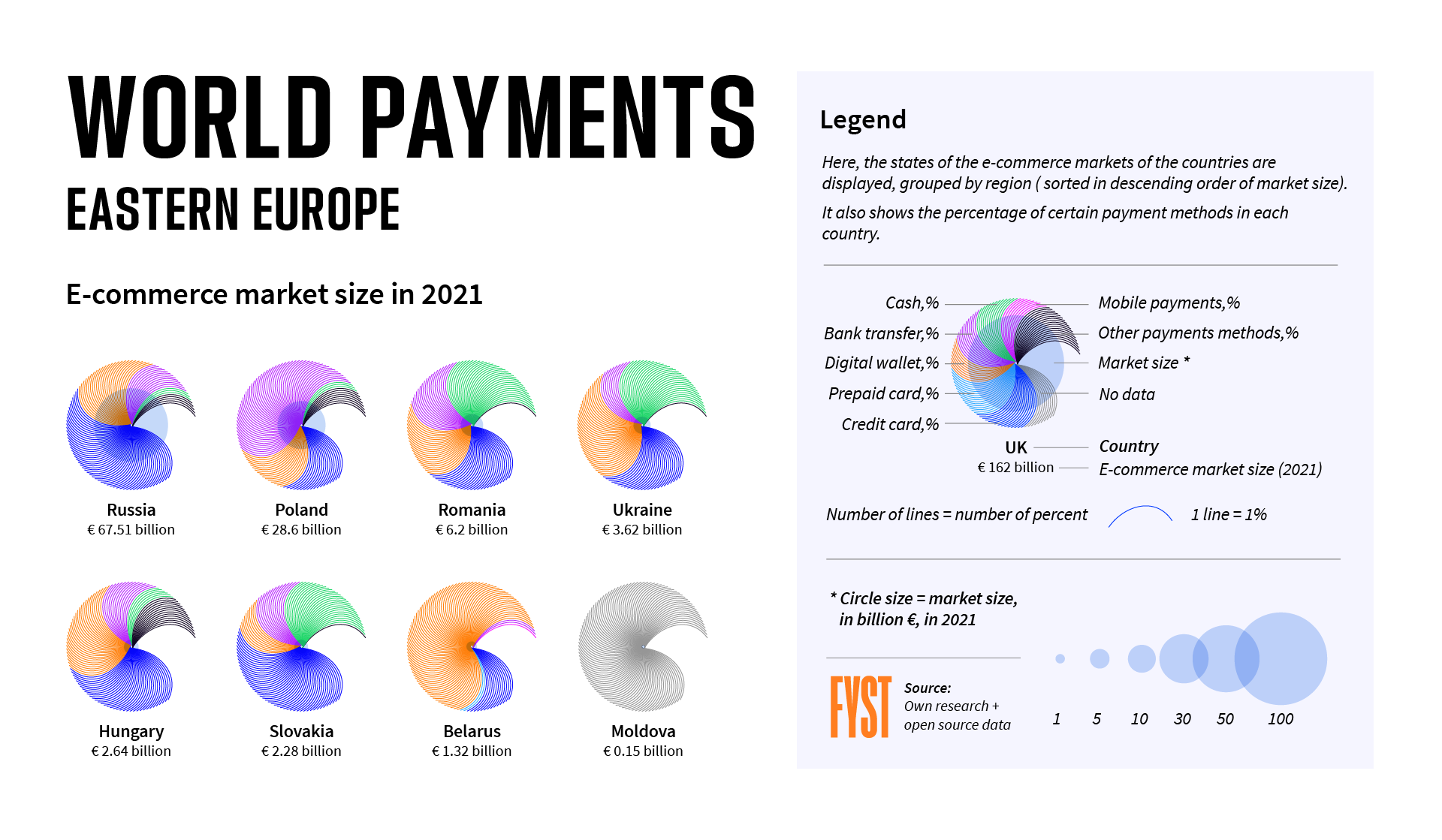

Russia

Ecommerce market size in 2021: €67.51 billion

Card - 54%

Bank transfer - 13%

Cash - 3%

Digital wallet - 25%

Other - 5%

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, JCB, Diners Club, Discover, UnionPay, MIR

Bank transfers: local bank transfers (Sberbank Online etc)

Digital wallets: Qiwi, YooMoney, FK, WeChat Pay, Alipay, Apple Pay, Google Wallet, Samsung Pay, PayPal

Mobile carrier billing: Beeline, MTS, Megafon, Tele2

- The domestic payment scheme MIR has been built to challenge Visa and Mastercard. In 2021, nearly 114 million MIR cards were issued.

- An estimated 80% of Russian internet users are online shoppers and online sales made up 12% of Russia’s total retail sales in 2021.

- The three most popular methods of online payment in Russia are Sberbank Online, bank cards and YooMoney.

Poland

Ecommerce market size in 2021: €28.60 billion

Card - 18%

Bank transfer - 54%

Cash - 3%

Digital wallet - 17%

Other - 8%

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, Diners Club, JCB, Discover, UnionPay, Paysafecard, Neosurf

Bank transfers: Blik, Trustly, Ecopayz, P24

Digital wallets: Mifinity, Apple Pay, Google Wallet, Muchbetter, WeChat Pay, Alipay

- The market share of ecommerce in total retail expenditure was estimated to be between 15%-18% in 2021.

- BLIK is the digital A2A payment service offered by Polish banks, and is based on co-operation between banks, payment acquirers and merchants, enabling a single integrated platform across all mobile devices.

- In 2021, there were over 10 million BLIK users, making 763 million transactions for total value PLN 103 billion, rising 80% and 82% respectively from 2020.

Romania

Ecommerce market size in 2021: €6.20 billion

Card - 26%

Bank transfer - 19%

Cash - 31%

Digital wallet - 23%

Other - 1%

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, V PAY, American Express, JCB, Diners Club, Discover, Paysafecard

Bank transfers: Trustly, Neteller,

Digital wallets: Gopay, Twisto, OrangeMoney, Skrill,

Cash-on-delivery: Selfpay, PayPoint

- There were around 25,000 active online merchants in Romania in 2021. Before the COVID-19 pandemic, 75% of online payments were made via cash-on-delivery.

- Across Eastern Europe, Romania had the most enterprises selling within the country at 98%, while 51% of Romanian enterprises made online sales to other European countries.

Ukraine

Ecommerce market size in 2021: €3.62 billion in 2021

Card - 25%

Bank transfer - 9%

Cash - 30%

Digital wallet - 35%

Other - 1%

Cards accepted: PROSTIR, Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, JCB, UnionPay

Bank transfers: IBOX, EasyPay, GlobalMoney, 2click

Digital wallets: Apple Pay, Google Pay, PayPal, iPay, City24, Apple Pay, Google Wallet, PayPal, WeChat Pay, Alipay

Mobile carrier billing: Kyivstar, Vodafone, Lifecell, 2click

- The domestic card payment scheme PROSTIR is accepted by 95% of all ecommerce merchants in Ukraine.

- In 2021, 44% of the Ukrainian population shopped online, with 28% of online shoppers buying cross-border. Cross-border ecommerce comprised 12% of all B2C e-commerce spend.

- Ecommerce comprised 11% of total retail sales in 2021.

Hungary

Ecommerce market size in 2021: €2.64 billion

Card - 36%

Bank transfer - 14%

Cash - 6%

Digital wallet - 30%

Other - 14%

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, V PAY, American Express, JCB, Discover, UnionPay, Aura, Paysafecard

Bank transfers: Trustly, Rapid Transfer, Neteller

Digital wallets: Skrill, Simple, Mifinity, eZeeWallet, Apple Pay, Google Wallet, PayPal, WeChat Pay, Alipay, Gopay, Sticpay

- In 2020 instant payments were launched in Hungary and enjoyed strong growth in 2021, comprising almost 40% of all domestic credit transfer transactions, with almost 80% of retail customers having access to a request-to-pay service and over 60% having access to QR code payments.

- The use of cash on delivery for online shopping is falling out of usage gradually, but still made up around 30% of ecommerce transactions in 2021.

Slovakia

Ecommerce market size in 2021: €2.28 billion

Card - 48%

Bank transfer - 14%

Cash - 27%

Digital wallet - 10%

Other - 1%

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, V PAY, American Express, JCB, Diners Club, Discover, Paysafecard

Bank transfers: local bank transfers, Wise

Digital wallets: Skrill, Viamo, Gopay, Apple Pay, Google Wallet, Samsung Pay, PayPal, WeChat Pay, Alipay

- Slovak ecommerce has grown by double-digit rates in recent years, with an estimated 14,000 e-shops currently in business in 2021, and over 6,000 card-accepting online stores.

- Online card payments rose 31% in 2021, while 32.6 million ecommerce card payments were made in 2021 worth €1.21 billion, up 38.1% and 37.5% respectively from 2020.

Belarus

Ecommerce market size in 2021: € 1.32 billion in 2021

Credit card - 14%

Prepaid card - 2%

Mobile payments - 1%

Bank transfer - 2%

Digital wallet - 81%

Cards accepted: BelCard, Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, UnionPay, JCB, MIR

Bank transfers: WebMoney

Digital wallets: YooMoney, Qiwi, WalletOne, Apple Pay, Google Pay, Samsung Pay, PayPal

Mobile carrier billing: Mobiamo

- The domestic card payment scheme BelCard enables online payments, including in Russian online stores. All cards with international brands are accepted in online shops.

- As of 2021, around 50% of Belarusian internet users made purchases in online shops. There were around 28,000 online stores in Belarus.

- The number of ecommerce users is set to rise to 4.5 million by 2025.

Moldova

Ecommerce market size in 2021: €148 million (up 12% from 2020)

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, V PAY, American Express, JCB, UnionPay

Bank transfers: Xoocash, Bpay

Digital wallets: Qiwi, OrangeMoney, Apple Pay, Google Wallet, PayPal, WeChat Pay, Alipay

- Usage of payment cards is at a very low level in Moldova, with the vast majority of card transactions used for in-store POS transactions and cash withdrawals.

- As of 2021, 14.95 million ecommerce transactions were made worth MDL 6,573.0 million, up 35.86% and 37.84% respectively from 2020.

- High mobile phone penetration at more than 85% of the population will see a boost in mobile ecommerce over the next few years.

Kazakhstan

Ecommerce market size in 2021: €2.09 billion

Card - 24%

Bank transfer - 24%

Cash - 46%

Digital wallet - 1%

Other - 5%

Cards accepted: Altyn, Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, JCB, Diners Club, Discover, UnionPay, MIR

Digital wallets: Apple Pay, Google Wallet, Samsung Pay, PayPal, WeChat Pay, Alipay, Qiwi

Mobile carrier billing: Beeline, Kcell, Altel, Tele2, Activ, Kassa24

- Almost one-fifth of the total volume of online retail in 2021 was done via mobile phones. E-commerce volume and value has been showing double-digit growth for the last three years at least and is set to grow strongly over the next few years.

- E-commerce retail is estimated to represent around 20% of total retail trade. As of 2021 there were over 2,500 online e-commerce stores in Kazakhstan.

- 70% of Kazakhstan’s e-commerce purchases are products, mostly construction material and household appliances, and 30% are services, mostly flight and train tickets, tickets for cultural events and communal services payment.

Azerbaijan

Ecommerce market size in 2021: € 3.7 billion

Credit card - 27%

Prepaid card - 1%

Mobile payments - 58%

Bank transfer - 1%

Digital wallet - 2%

Other - 11%

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, JCB, Diners Club, Discover, UnionPay, MIR

Bank transfers: Neteller

Digital wallets: Skrill, Kassam, Azericard, Rabita Mobile, SmartPay, CIB, Portmanat, ExpressPay, Epul, Apple Pay, Google Wallet, Samsung Pay, WeChat Pay, Alipay

Cash-on-delivery: hesab, Million, ExpressPay, Emanat

- In 2021, around 86% of Azerbaijani consumers had made online purchases, and ecommerce’s share of retail spending stood at 4.6%. The share of e-commerce in retail is expected to reach nearly 10% over the next few years.

- All cards with international brands are accepted in Azerbaijani online stores.

- Most ecommerce transactions are conducted with debit cards, although credit card volumes are gradually increasing.

Uzbekistan

Ecommerce market size in 2021: €550 million

Credit card - 16%

Prepaid card - 16%

Mobile payments - 16%

Bank transfer - 16%

Digital wallet - 34%

Other - 2%

Cards accepted: UzCard, HUMO, Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, JCB, UnionPay, MIR, Qulay Pul

Bank transfers: local bank transfers, Wise, Remitly

Digital wallets: WebMoney, Qiwi Wallet, Skrill, PayPal

- Domestic card payment schemes such as UzCard, HUMO and bank mobile apps are the most popular ways Uzbeks use mobile payments.

- Most Uzbek banks allow customers to link their bank cards to their smartphones. Social media platforms such as Facebook are used by Uzbek consumers to buy products such as health and beauty items.

- In 2021, ecommerce comprised 70% of total digital revenues in Uzbekistan.

Armenia

Ecommerce market size in 2021: €1.06 billion in 2021

Credit card - 52%

Prepaid card - 4%

Mobile payments - 4%

Bank transfer - 4%

Digital wallet - 36%

Cards accepted: ArCa, Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, JCB, Diners Club, MIR

Bank transfers: WebMoney,

Digital wallets: YooMoney, Qiwi, Skrill, Mobidram, ArCa, PayPal, Apple Pay, Google Wallet, Samsung Pay, WeChat Pay, Alipay

- According to the Central Bank of Armenia, in 2021, there were 46.57 million internet transactions (+40.74% on 2020) with a total value of AMD 576.16 billion ($1,143.7 million).

- All cards with international brands are accepted in Armenian online stores.

Georgia

Ecommerce market size in 2021: € 40 million in 2021

Credit card - 89%

Prepaid card - 1%

Mobile payment - 1%

Bank transfer - 1%

Digital wallet - 5%

Other - 3%

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, Diners Club, UnionPay, JCB, Paysafecard

Bank transfer: WebMoney

Digital wallet: Apple Pay, WalletOne, Skrill, PayPal

Mobile carrier billing: Mobiamo, Boku

- In 2021, 21% of Georgian consumers made ecommerce purchases, and 49% of ecommerce purchases were conducted at Georgian online retailers.

- All cards with international brands are accepted in Georgian online stores.

Kyrgyzstan

Ecommerce market size in 2021: € 100 million in 2021

Cards accepted: ElCard, Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, Diners Club, UnionPay, JCB, MIR

Bank transfers: WebMoney, PaySend

Digital wallets: Qiwi, YooMoney, WalletOne, PayPal, Skrill, PayPal, WeChat Pay, Alipay

Mobile carrier billing: Boku, Mobiamo

- Visa is the most popular international brand, while the domestic payment card scheme ElCard is growing in usage, particularly through its mobile app.

- The ElCard Trade mobile app enables merchants in the country to receive non-cash payments for goods or services, including QR code payments.

- In 2021, the number of online acceptance locations was around 95,000.

Tajikistan

Ecommerce market size in 2021: € 185 million

Cards accepted: Korti Milli, Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, Diners Club, UnionPay, JCB, MIR

Bank transfers: WebMoney

Digital wallets: YooMoney, Qiwi, Skrill, PayPal, WeChat Pay, Alipay

Mobile carrier billing: Boku, Mobiamo

- The domestic card payment scheme Korti Milli is the most popular card payment method, comprising nearly 60% of online card payments, following by Visa, Mastercard and UnionPay. Korti Milli can be co-branded with UnionPay.

- Around 10% of Tajikistan consumers shop online due to a lack of internet infrastructure, however the country’s ecommerce market size is estimated to be worth around US$60 million.

- Tajikistan has a population of 9 million with 2.6 million internet users who could be potential buyers of online products and services.

Conclusion – the importance of localising payments by market

What’s most important for merchants when they’re trying to grow? Is it offering the widest product range at the lowest prices? Or having the most eye-catching advertising campaign? Merchants often forget to put themselves in their customers’ shoes, especially those entering the site for the first time. What do customer see? How easy is it for them to find what they’re looking for? And can they pay in the way they want to pay?

The global ecommerce landscape is getting more crowded and brutally competitive, and consumers are more impatient and demanding than ever before. The breakneck pace of payment technology innovation is putting even more pressure on merchants to offer their customers even quicker and easier payment journeys. It’s easy to forget just how much work goes on behind the scenes to get a fast checkout process in place – and the challenges of slashing the dreaded cart abandonment rate are even harder when trying to sell to international customers.

In summary:

- Adding localised payment methods, local currencies and optimising the payment funnel are no-brainers when trying to grow cross-border ecommerce sales. Putting these in place will undoubtedly help to attract customers and raise checkout conversions.

- As cross-border payments get more complex, it’s not just consumers who need payments to be made as simple as possible at the checkout stage. Merchants too need to have payment gateways and platforms that are easy to use and simple for them to navigate, so they can give their customers the best experience possible.

- Merchants are becoming fed up with having to work with multiple acquirers and platforms for different types of transactions or services. Merchants want everything run through a single, easy to use platform, enabling them to accept localised payment methods, offering a transparent view of all data.

- Unified payment gateways deliver all the things merchants need - a simplified, faster, and smoother buying experience for customers on all devices, localised currency and language support, plug-and-play and API integrations, and deep data analytics functionality to aid marketing strategies and checkout conversions.

All of these elements give merchants the 360-degree overview of customer behaviour they need to fine-tune their businesses, strengthen their revenue streams, and reach far into new markets and customer bases.

At FYST, we have one clear mission - by removing geographical limitations and simplifying complex processes, we enable businesses in all sectors to navigate the fast-growing cross-border ecommerce market.

Simply put, FYST is a one-stop payments consultancy for ecommerce businesses, empowering merchants with a unique mix of agile digital payments capabilities, unrivalled personalised support, and compliance and AML advisory services.

Our fresh, creative approach to solving long-standing, business-limiting problems is a breath of fresh air in the payments space. We have created a diverse team of successful industry pioneers who not only understand the importance of payments, but how to put people and intuitive UX at the heart of business growth.

We’re not reinventing the wheel – we’re reimagining money to help our merchants move it easier, earn it faster, and make it flex in new ways.

If you want to find out how to optimise your online presence and unlock game-changing payment method acceptance, contact FYST today.