Executive summary

While consumer and merchant attention is often focused on acceptance, acquiring is the vital link in the payment chain, seen as a largely offline component of payment processing. But the merchant acquirer is an essential middleman, taking the details of transactions provided by merchants, running the details through the relevant card scheme and onto the card issuer, enabling the transaction to be processed.

Without the merchant acquirer, there is nothing to connect merchants with the broader payment ecosystem, or ensure secure and efficient payment processing, or even effectively protect against fraud. Acquirers also play a crucial role in compliance with regulatory standards and are the secret ingredient to a positive customer experience.

With all that said, it’s perhaps unsurprising that traditional acquiring is now increasingly attractive to fintech, leading merchant payments and card acquiring businesses to be transformed in recent years by technology-driven innovations. It also means there’s never been more opportunity for merchant acquirers to differentiate their offering by adding enhanced services. By leveraging technology and collaborating with stakeholders across the payment ecosystem, merchant-acquiring companies stand to make major inroads into this lucrative segment. But first, it’s important to understand the things that matter to acquirers, the regulations they struggle to navigate and what a successful acquiring platform looks like.

FYST has produced this report to paint a picture of today’s acquiring landscape, outlining the technology driving its evolution, and revealing the must-watch trends that will shape its future.

PART 1 – TODAY’S ACQUIRING LANDSCAPE

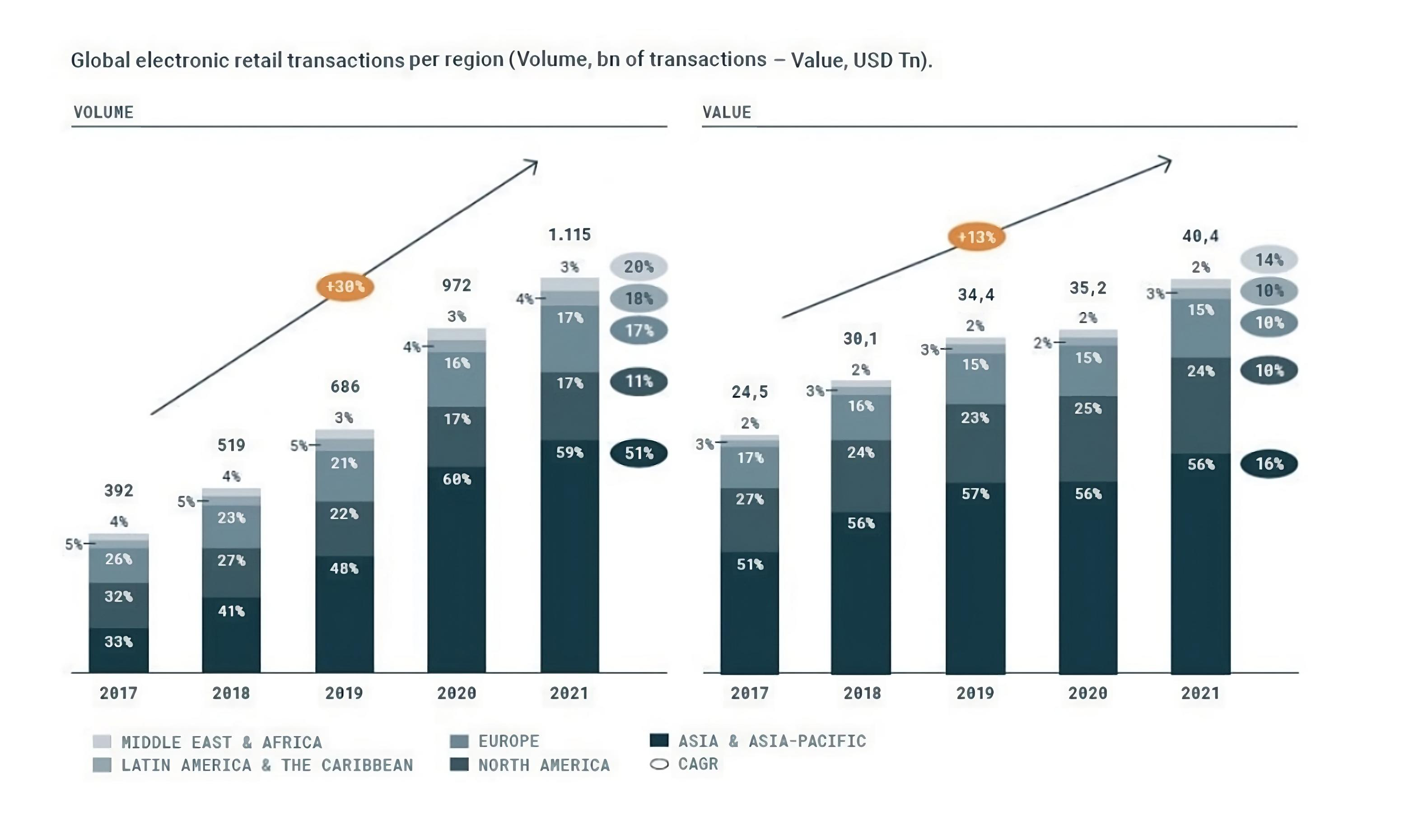

Between 2017 and 2021, the electronic payments industry grew at 30% and 13% CAGRs in volume and value of transactions respectively.

For card acquiring specifically, the volume of transactions grew at 23% over the same period.

This growth continues, with global merchant acquiring volume set to hit $41 trillion by 2026, driven by sky-rocketing e-commerce growth, soaring contactless usage and new business models that came about as a result of the global pandemic. It’s fair to say that Covid-19 forever changed the face of acquiring, so, in a post-Covid world, what does the acquiring landscape look like?

IMPACT OF COVID

It’s easy to attribute many of the changes in payments and the surge in e-commerce to the pandemic, but in reality, acquirers were already preparing for strong growth in digital payments long before the lockdowns started. The pandemic simply put plans into fast-forward.

Acquirers were forced to assess their business models as brick-and-mortar retailers pivoted to online trading almost overnight. This created a huge opportunity for acquiring banks that could provide payment gateways as part of their offering, capable of supporting both a high volume of payments and a wide range of alternative payment methods.

Acquiring banks have often outsourced these gateways to third parties, but acquirers are now recognising the opportunity of bringing this service in-house, as it gives them direct oversight over a growing part of the business and delivers higher margins on already increased revenues. E-commerce grew 17% and digital payments 19% globally in 2021, thanks to national lockdowns, hygiene concerns around cash and higher contactless card limits.

Source: Arkwright

Source: Arkwright

Of course, as the shift to digital commerce and payments accelerated, card-not-present and friendly fraud rose alongside it. E-commerce losses to online payment fraud were estimated at $20 billion globally in 2021, a rise of nearly 15% compared to the $17.5 billion recorded the previous year.

As fraud levels increase, so does the likelihood of falling victim to it, and acquirers that keep up-to-date with the fraud threat landscape are uniquely positioned to protect the end user. Payment providers have developed sophisticated fraud detection technologies that recognise patterns indicating fraud and can intervene before a transaction is processed. These tools now make use of sophisticated machine learning (ML) and artificial intelligence (AI) algorithms to analyse a vast amount of data and allow acquirers to spot behavioural patterns that can prevent scams and help combat fraud.

HOW MERCHANT ACQUIRER CONSOLIDATION IS CHANGING THE PLAYING FIELD

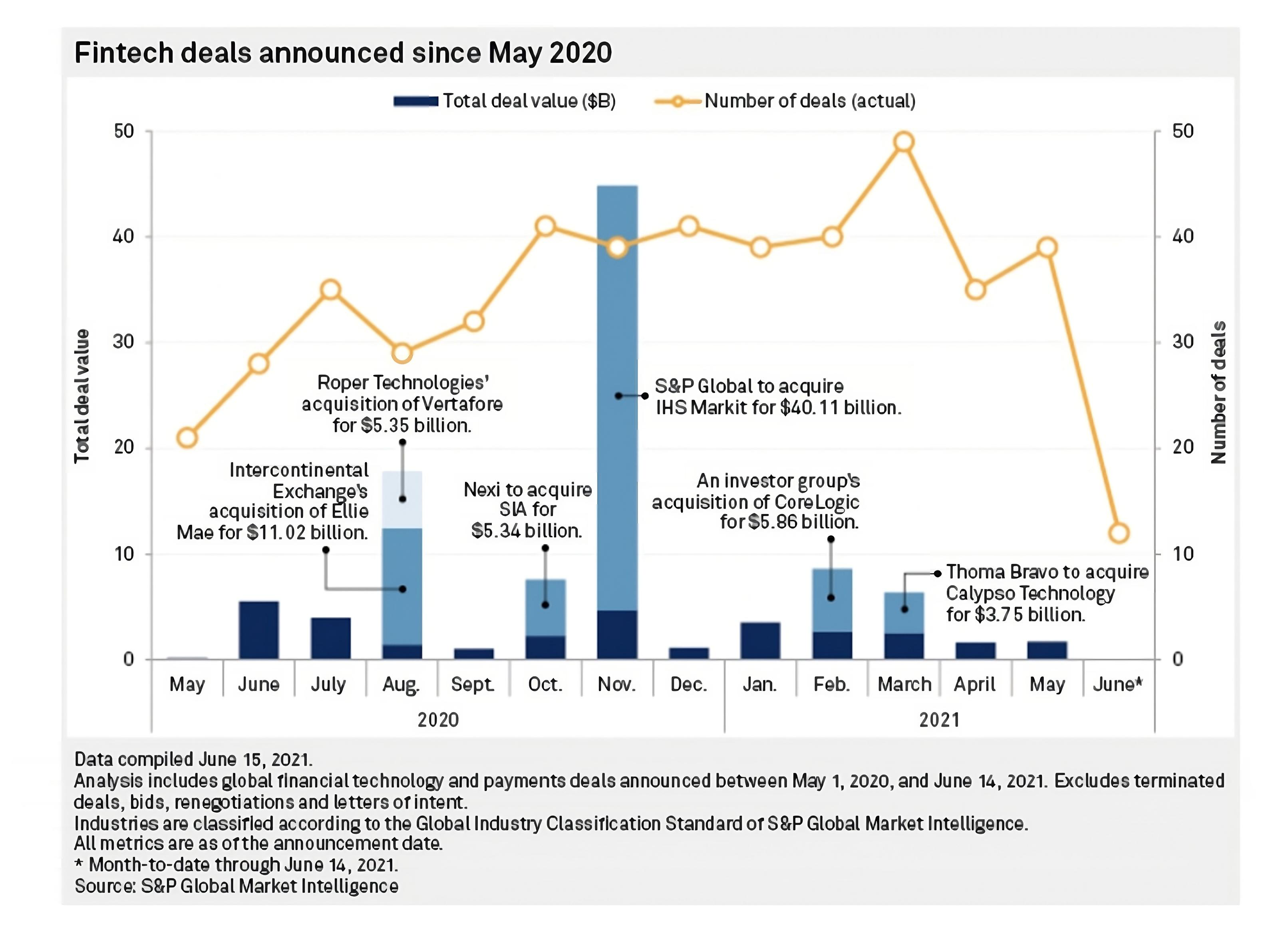

If the pandemic had the biggest impact on merchant acquiring in recent years, consolidation has come a very close second, as evidenced by the fact that two of the largest acquisitions in recent history came from the payments industry: Worldpay acquired by FIS for $43B, and First Data acquired by Fiserv for $22B. All four companies are in merchant acquiring.

These acquisitions not only remind us of their value, but are indicative of a wider trend in the payments industry.

In the five years preceding these mega-mergers, First Data, Global Payments, TSYS and Worldpay spent a reported US $10 billion on acquisitions to boost their integrated payment efforts.

The past five years has seen a flurry of mergers, acquisitions, and investments. In 2019 alone, there were more than 30 mergers and acquisitions within the U.S. acquiring space. These mergers and acquisitions aren’t just about scale, they are about extending capabilities with merchants and capitalising on the increasing value of integrated payments. Many acquirers have also invested in acquisitions to strengthen their e-commerce and omni-commerce capabilities – another reaction to changing post-pandemic consumer habits.

The consolidation trend is happening across the payments processing industry, with acquisitions, white-labelling agreements and joint ventures creating a relatively small number of major players, and it’s widely accepted that the consolidation trend will continue, with plenty of high-profile examples already demonstrating success:

- 2021 saw France’s Worldline acquire 80% of Italy’s Axepta, the merchant acquiring entity of the BNL banking group in Italy. Founded in 2006, Axepta Italy is one of the large bank-owned acquirers in the country. It acquires around 200 million acquiring transactions per year (giving it a 5% market share) from a 220,000-strong POS terminal acceptance network. In the continuity of Worldline’s existing partnerships with more than 17 banks and banking federations in Italy, the creation of a joint venture with BNL (BNL retaining a 20% ownership in Axepta Italy) is also designed to be an open vehicle for welcoming existing partners and other Italian banks looking for enhanced scaling and cost efficiencies.

- In November 2022, Worldline announced it had signed a binding agreement for the acquisition of Banco Desio’s merchant acquiring activities and the planned set-up of a commercial partnership aiming to leverage Banco Desio’s banking network, in order to distribute Worldline’s payment products and services to merchant customers of the bank in Italy. Banco Desio Group’s merchant acquiring portfolio delivers payment solutions to around 15,000 merchants generating 40 million transactions per year, representing €2 billion of acquired transaction value. It also manages the marketing and distribution of more than 19,000 POS terminals to the merchants within the bank’s network. As part of the transaction, Worldline will enter a long-term commercial partnership with Banco Desio as a key commercial channel in order to distribute Worldline’s payment product and services to merchants.

- Nexi, the Italian behemoth formed from absorbing Nets and SIA, is also making more moves in acquiring. In November 2021, Intesa Sanpaolo teamed up with Nexi for the transfer of the POS acquiring business line of the former UBI banking entity, which Intesa Sanpaolo acquired. The deal is in keeping with the strategic partnership launched with the Nexi Group in June 2020 with the contribution of Intesa’s acquiring business line. Nexi followed up that deal in June 2022 with its acquisitions of the acquirer businesses of BPER Banca and Banco di Sardegna.

- Greece is also a hotbed of acquiring activity, with Worldline sealing a €256 million deal for Eurobank Merchant Acquiring, one of the main acquirers in Greece with a 20% market share. Eurobank Merchant Acquiring manages 219 million transactions acquired per year, representing a payment volume of €7 billion from a 190,000-strong POS network and a portfolio of 123,000 merchants.

- In 2021, Piraeus Bank’s merchant acquiring unit recorded card transactions increasing by 23% in terms of turnover value, 19% in terms of transactions volume and 40% in terms of net result from 2020. At the end of the year, Piraeus Bank had 243,000 EFT/POS terminals installed in more than 200,000 points of sale.

Source: Spglobal

ONGOING ACQUIRING CHALLENGES

In the wake of increasing fraud and declining profits, merchant acquirers face a plethora of challenges.

Evolving fraud

The changing fraud landscape is arguably the biggest threat to acquirers. Shifts from card-present (CP) fraud to card-not-present (CNP) strategies place the burden of risk on merchants, and the changing consumer preference for omni-channel e-commerce makes effective security a daunting task.

Reduced profit margins

Rewind to the days of national lockdown, when shopping online was not only necessary but something of a novelty (not to mention a boredom-breaker). Merchant acquirer profit margins were multiplying quickly as a result. But as online shopping settled into a norm, happily co-existing with re-opened bricks-and-mortar retailers, this ceased to be the case. Merchant acquiring remains a highly competitive yet low margin business where a difference in hundredths of a percent, for example being charged 1.56% instead of 1.57%, can prompt large merchants to leave for another acquirer.

Navigating regulations

Merchant acquirers often struggle with various regulations, depending on the regions in which they operate and the specific services they offer. For instance, under the single euro payments area (SEPA) Cards Framework (SCF), there is a drive to standardise the interface between merchants and merchant acquirers. The idea is to deliver a consistent merchant experience when there are no technical or practical barriers preventing SEPA merchants from accepting all SCF compliant cards.

Regulations that apply to merchant acquirers vary by country and region, but there are some common regulations and standards that often apply:

- Payment Card Industry Data Security Standard (PCI DSS): a set of security standards designed to ensure all companies that accept, process, store, or transmit credit card information maintain a secure environment.

- Anti-Money Laundering (AML) regulations: Merchant acquirers are subject to AML laws and regulations aimed at preventing money laundering and the financing of terrorism.

- Know Your Customer (KYC) requirements: these mandate that merchant acquirers verify the identity of their merchant customers to help prevent fraud and illegal activities.

- Consumer protection laws: Depending on the region, there may be various consumer protection laws that merchant acquirers need to adhere to, particularly when dealing with credit and

debit card transactions.

- Payment industry regulations: There are specific regulations that relate to the payments industry, such as the Dodd-Frank Wall Street Reform and Consumer Protection Act in the United States, which brought about changes in the payment processing industry.

- Data protection and privacy laws: Regulations such as General Data Protection Regulation (GDPR) in Europe may apply to merchant acquirers that handle personal data.

- Network rules: payment card networks such as Visa, MasterCard, and American Express, which have their own compliance requirements that acquirers must follow.

- Licensing and registration: In many jurisdictions, merchant acquirers must obtain licenses or register with relevant regulatory authorities.

- Consumer Financial Protection Bureau (CFPB) Regulations (in the United States): The CFPB may have regulations that apply to merchant acquirers, especially in cases where they are involved in consumer financial transactions.

- Cross-border transaction regulations: If a merchant acquirer operates across international borders, they may be subject to additional regulations relating to cross-border transactions and currency exchange.

It's essential for merchant acquirers to stay informed about the regulations that apply to their specific location and business offering.

A new kind of competition

It's no secret that traditional acquirers are feeling the pressure from industry disruptors who are developing new, more convenient services that eliminate inefficiency. Small businesses in particular are shifting to integrated software vendors (ISVs), adopting value-added services, and addressing customers’ preference for omnichannel commerce.

Almost half of smaller merchants are already using ISVs as their primary payments provider, and even more are considering moving to ISVs. For incumbent acquirers, this poses a significant threat. In many cases, even when small businesses use ISVs, incumbent acquirers process the transactions, maintaining the small merchants’ volume but losing out on most of the revenue opportunity to the ISVs that own the merchant relationship.

In response, some incumbents have acquired ISVs, while others have built their own software to compete. But competing with ISVs as a group can be difficult, as they tend to specialise in verticals – an attractive USP for merchants.

These acquiring challenges aren’t going away. Now is the time to harness new technologies that will give merchant acquirers the competitive edge. As previously mentioned, consolidation means there is less competition in the merchant acquiring space, but the competition that remains is fierce. It’s never been more important to stand out from the crowd.

PART 2 – HOW CAN ACQUIRERS PROVIDE ADDED-VALUE SERVICES

There’s no doubt that technology has shaken up the acquiring value chain. From contactless payments and EMV chip integration to tokenisation and cross-border solutions, paytech has redefined the merchant journey, simplified pricing structures and improving the merchant and consumer experience.

Now fintechs, processors, software vendors, gateways, payment facilitators, service organisations and POS vendors are all vying alongside acquirers, and each other, to create even more added value for merchants and their customers.

This competition means standing out is essential, and that means finding new ways to give the people what they want. There is real opportunity for acquirers to thrive and compete if they embrace value-added services and technology, which will play a larger role in acquiring as the commoditisation of payment processing services continues.

There are many services acquirers can offer to stand out from the competition, such as:

- Payment processing

- Authorisation and authentication

- Payment gateway integration

- Multi-currency support

- Payment network connectivity

- ACH and EFT processing

- Mobile payments and NFC support

- E-commerce and POS integration

- Recurring billing and subscription management

- Real-time transaction monitoring

But to truly cater to the needs of modern merchants and consumers, acquirers need to focus on offering local services, bolstering fraud detection, and unlocking the full potential of AI and data analytics.

LOCAL SERVICES

Local acquiring simply means the acquirer is based in the same country where a payment is made. It offers something of a home advantage, as the transaction takes place in an environment that is familiar to the issuing bank, therefore increasing the chances of success.

Local acquiring is an attractive proposition for businesses looking to improve their performance and profitability in the global market, including:

- Improved authorisation rates – when a merchant opts for international acquirers, the approval rate usually ranges from 30% to 50%, while local acquirers can generate approval rates from 70% to 90%.

- Reduced costs - typically, businesses that use cross-border acquiring are subjected to additional fees because the transaction is international. Furthermore, interchange fees – the fees paid by the acquirer to the cardholder’s bank – are often lower for domestic transactions.

- Enhanced customer experience - local acquiring can contribute to a positive customer experience by reducing payment failures and ensuring that transactions are as seamless as possible.

Additionally, local acquiring can simplify the ever-evolving regulatory landscapes and compliance processes for businesses. Keeping transactions within the local regulatory framework means avoiding potential legal issues that can arise from international transactions.

ADDING VALUE THROUGH FRAUD DETECTION

Losses on ecommerce online payment fraud hit $41 billion in 2022 and it is predicted the cumulative losses to online payment fraud globally between now and 2027 will exceed $343 billion.

Supporting merchants’ fraud prevention efforts is one area where there is scope to add value to the acquiring process, and is a mutually beneficial move. Many retailers are facing tighter margins because of the economic downturn; the financial impact of fraud and chargebacks becomes greater during a recession, when the average percentage of revenue lost to a fraudulent transaction increases by 39%.

A potential rise in chargebacks could be very costly for acquirers, as they are ultimately responsible for each merchant’s activity and financially responsible if a merchant is unable to meet their obligations.

Acquirers can help identify fraudulent card use, which helps the issuer detect a compromised card and protects merchants from an unexpected rise in chargeback rates. For example, an acquirer can highlight if an unusually large number of refunds are being processed at a single POS, indicating that an employee is acting fraudulently by processing payments and then refunding them to avoid credit card charges.

An active investigations unit may also serve as a market differentiator for acquirers. Acquiring banks are in a prime position to pick up on fraud trends, as they have visibility over a much wider range of transactions than issuing banks.

THE POTENTIAL FOR AI AND DATA ANALYTICS

The growing trend for using AI in payment processing is shaping the landscape of digital payments and driving its value globally, and it’s a game-changer for acquirers and merchants alike. AI tools can streamline payment processing by automating repetitive tasks, reducing errors, and creating more valuable time to focus on strategic tasks.

AI can lead to significant benefits for merchant acquirers that, in turn, benefit their merchant customers. These include:

- Fraud detection: AI can analyse transaction data in real-time to detect fraudulent activities and flag potentially suspicious transactions, reducing chargebacks and financial losses. In 2022, global business spend on AI-enabled financial fraud detection and prevention strategy platforms is estimated at just over $6.5 billion.

- Compliance and security - AI can assist acquirers in monitoring and ensuring compliance with evolving regulatory requirements, such as KYC and AML regulations, and continuously monitor for potential security threats and vulnerabilities in the payment processing system, providing early detection and mitigation.

- Credit risk assessment: AI models can assess the credit risk of merchants, helping acquirers make informed decisions about underwriting and setting appropriate credit limits.

- Customer insights and segmentation: AI can help acquirers understand their merchant customers better by segmenting them based on their behaviour, preferences, and needs. This information can be used to tailor services and offerings. AI can also predict merchant churn or identify opportunities for upselling and cross-selling, helping acquirers improve customer retention and revenue.

- Payment processing: AI-powered algorithms can optimise payment authorisation processes, helping acquirers increase successful transactions and reduce false declines, as well as dynamically route transactions to the most cost-effective or reliable payment networks, enhancing operational efficiency.

By leveraging AI, merchant acquirers can enhance their services, reduce operational costs and mitigate risks to better serve their merchant clients.

Of course, AI is also an invaluable tool when it comes to data analytics, which in payments means collecting, standardising and analysing data from various alternative payment methods and providers across debit cards, credit cards, BNPL providers, mobile and crypto wallets, and bank transfers.

This data provides rich, actionable insights into payments performance, operational efficiency and, as a result, revenue. By examining payments data, businesses can discover and learn from patterns, trends, and correlations to inform strategy and optimise operations.

AI does the heavy lifting by extracting insights from transaction data, helping acquirers make informed business decisions and offer data-driven services to their merchant clients, as well as help acquirers track and analyse key performance indicators (KPIs), enabling data-driven improvements in service quality and profitability.

A SINGLE, INTEGRATED SOLUTION

Merchants are increasingly looking for integrated, holistic services that reduce the need for manual intervention and reconciliation. Data indicates that in the UK, as of 2021, providers with “easier” onboarding processes like Square and Shopify have grown their awareness to 33% and 21% respectively.

These solutions can often be tailored to meet the specific needs of different industries and businesses, but key components of an integrated acquirer solution include:

- Payment processing, allowing merchants to accept payments from customers using various payment methods.

- POS systems: Integration with POS systems and hardware to facilitate payment acceptance at physical locations.

- E-commerce integration: Tools and APIs for integrating payment processing into online stores or e-commerce websites.

- A payment gateway to facilitate the secure transmission of transaction data.

- Fraud detection and prevention tools to help minimise the risk associated with electronic payments.

- Reporting and analytics: Access to transaction data and reporting tools for merchants to track and analyse their payment processing activities. Platforms that act as repository for clean, model-ready datasets can become a great enabler for merchants, and acquirers can monetise such data by opening it to third parties to build value-added services.

- Compliance and security: Ensuring that the payment processing system complies with industry standards and regulations.

- Settlement and reconciliation: Tools and processes for reconciling transactions and settling funds with the merchant's bank account.

Acquirers should consider creating a single payments hub that integrates data, pricing, and functionality across all channels for their merchant customers.

PART 3 – LOOKING AHEAD

The merchant acquiring industry is subject to a significant and ongoing change driven by the dynamics shaping the retail industry. To thrive in what continues to be a challenging economy, acquirers will have to take these changes into account going forward.

THE CHANGING RETAIL LANDSCAPE

Just like the acquiring industry, retail is in a state of constant change. Since one industry inevitably impacts the other, these changes need to be anticipated and monitored. Over the last two decades, the various iterations of e-commerce (mobile commerce and social commerce), the development of new retail business models (such as marketplaces), and the emergence of omnichannel retail have driven demand for new acquiring business models and value propositions.

Looking ahead, social media – once just a place of social interactions – will become a more common platform for brands to engage their customers in shopping experiences, allowing them to immediately buy what they see without leaving an app, making it easier than ever to make a purchase.

This emerging field will have several impacts on merchant acquirers. Social commerce platforms often offer a wide range of payment options, including in-app purchases, digital wallets, and more. Merchant acquirers may need to adapt and support these payment methods to remain competitive and accommodate the preferences of social commerce users. Plus, with the increased volume of transactions and the unique nature of social commerce, merchant acquirers must invest in robust data security and fraud prevention measures. Social commerce may present new risks and challenges that acquirers need to address.

Acquirers should consider establishing partnerships or integrations with social media platforms and social commerce tools to offer seamless payment processing for businesses.

The overall competitive landscape in acquiring is further complicated by clients, mostly large retailers and marketplaces, developing their own payment solutions in addition to their app interfaces and loyalty programmes.

EMERGING RETAIL AND PAYMENTS TECHNOLOGY

New technology is the key driver in the evolution of any industry: retail, related payments acceptance, and merchant acquiring are no exception. In retail, the shift towards e-commerce has driven demand for efficient and secure online payment solutions for the growing number of transactions that are not confined to national jurisdictions. As businesses become more globalised, there is a need for payment solutions that can handle transactions across different currencies and regions. This trend is expected to accelerate in 2024, and while global acquiring can open up significant opportunities for businesses to extend their reach to international customers, it comes with challenges.

Every country has its own rules and regulations around payment processing, and dealing with international transactions can increase a business’s exposure to fraud and security risks, not to mention that consumer behaviour and preferred payment methods can vary greatly from one region to another. While these aspects of global acquiring are daunting, they are manageable with the right strategies, technologies and partners.

REGULATION UPDATES

Regulatory changes by governments and central banks will continue to impact the industry, ranging from the complexities and increased cost of compliance, GDPR and data-residency requirements to the rise of new payment types enabled by real-time payments (RTP). Changes are also likely to come from fintech innovators and new competitors, enabled by the lowering of licencing barriers and access to the provision of payments and transaction related services from open-banking regulation and payment service provider licensing.

PAYTECH TRENDS TO WATCH, AND HOW TO LEVERAGE THEM

- AI-based merchant acquiring services: Acquirers have started using artificial intelligence (AI) to monitor merchants and offer them a range of products and services that are different from competitors. A staggering 94% of banks use AI for this purpose, and 90% of banks use AI to improve operational efficiency. Other reasons for incorporating AI include – identifying barriers to profitability, frauds, low transaction volume, and short stays by merchants, and fixing them to improve the bottom line.

- Integrated payments: Integrated payments are growing popular among customers. 23% of customers are willing to delete their mobile banking app and embrace payment options that consolidate all payment information in one place. With APIs becoming cheaper and more accessible, merchants have started offering Banking-as-a-Service (BaaS) to customers to win customer loyalty and generate a new revenue stream. Merchants can engage with customers and deepen their relationships through such value-add services, and customers can enjoy the seamless experience of shopping and managing finance at the same time. Acquirers must understand the potential of integrated payments and collaborate with fintech companies to offer co-branded solutions to merchants.

- Rapid merchant payments: Typically, it takes a lot of time for merchants to get access to funds from a customer’s cards. The slow processing does not meet the merchant’s expectation of next-day fund access. Merchants want quick access to their money. This presents acquirers with a unique opportunity to deliver solutions that provide merchants with fast fund access.

- Cryptocurrency becomes mainstream: As more customers accept cryptocurrency payments, merchants have started adopting cryptocurrencies as a payment option to provide additional payment options to customers, become more crypto-friendly, improve engagement, and generate more revenue. According to Deloitte’s survey, 75% of retailers plan to accept cryptocurrency as payment in the next two years. 83% of retailers have already invested $1 million to create an infrastructure to accept digital payments.

Every year, acquirers lose over $2 billion due to merchant attrition. There are several reasons for merchants switching their providers, from dissatisfaction with how the acquirers handled their grievances, to high costs, and better solutions from competitors. The only way to stop merchant attrition is to provide differentiated services, quick resolutions to their problems, and use advanced security solutions, machine learning, and other services that add real value.

Now is the time for acquirers to assess their business models to ensure they can cope with both today’s high volume of transactions and the changes tomorrow will bring.