In 2020, only 17.8% of sales were online. As much as we hate to hark back to the pandemic and all the turmoil it caused, there’s no denying that it accelerated a pre-existing trend of more consumer and business payments shifting online. In 2023, more than 21% of global sales will take place online, rising to 23% or more by 2025, when total global ecommerce expenditure is set to hit $8.3 trillion.

While the mature ecommerce markets of the US, Europe and Asia have been well-documented, current and future ecommerce growth hotspots are the Latin America and Middle East and North Africa regions, both of which are now catching up to the rest of the world.

It’s clear that businesses, no matter where they are in the world, that aren’t optimised to sell online will be left behind. Today’s consumers don’t distinguish between small businesses and global giants. They expect the same smooth online payment experiences wherever they go. But how can businesses attract non-local buyers in the most cost-effective way?

Merchants, no matter what size they are, from micromerchants to multinationals, must offer the widest range of payment methods, no matter where their customers are based. Ensuring that customers have access to the relevant localised payment methods for their market will be crucial in achieving success.

As global ecommerce has skyrocketed, we’ve watched how digital wallets have surged to take nearly half of total ecommerce spending worldwide. That’s no surprise, considering rising smartphone penetration globally, enabling contactless, in-app and mobile payments in various guises. What’s certain is that we can expect online mobile payments to take an even bigger bite of overall non-cash payments over the next few years, particularly as domestic-only payment schemes give way to internationally-enabled schemes configured for the demands of global ecommerce.

It's estimated that the number of mobile devices connected to the internet will surge from 10 billion in 2015 to 29 billion by 2030. By 2025, more than 50% of global ecommerce spending is set to be conducted through more than 4.4 billion digital and mobile wallets. But while this may be true on a macro global scale, zooming in on individual markets shows a very different picture depending on where you’re looking.

What works in one region or country may be alien to another. What’s clear is that one market’s payment preferences are very different to another. In order for merchants to have the best possible chance to succeed, they need in-depth, granular data detailing differences between countries and continents. In payments, there’s no such thing as one-size-fits-all, especially when considering the monumental changes in consumer and business buying habits that have taken place over the last few years.

In this whitepaper, FYST unlocks its unique proprietary data, collected worldwide, to show why merchant payment method acceptance capabilities need to be updated to reflect fast-changing consumer preferences, driven by the relentless speed of payment innovation bringing new methods to market continuously.

FYST takes a deep dive into the national, pan-regional and global data on payment methods trends that will define online e-commerce trade throughout 2023 and beyond, so that online businesses can get primed to tap into new customer bases. We hope it inspires you to maximise the performance of your online brand and welcome sales from all corners of the globe.

Middle East and Africa Regional Overview:

In this whitepaper, FYST shows that consumers and merchants across the Middle East and Africa are becoming more comfortable with making online transactions through a range of methods.

Encompassing two continents stretching from South Africa to the Arabian peninsula and north to Turkey, the Middle East and Africa regions show wildly varying differences in ecommerce infrastructure from country to country. But the common denominator driving ecommerce as a whole is mobile commerce, with Africa forecast to surpass half a billion ecommerce users by 2025, with mobile commerce set to comprise 70% of online transaction value by 2025 in the Middle East and North Africa (MENA) region.

For ecommerce to be viable and successful, it requires high levels of internet and mobile network penetration, widespread supply chain logistics and transport infrastructure development, and the ability to accept digital payments through a range of methods. Thanks to the vast improvements to mobile and internet infrastructure over the past decade, there are opportunities for in-country and cross-border ecommerce merchants in these regions to expand online sales with the right payment acceptance strategies tailored to local markets.

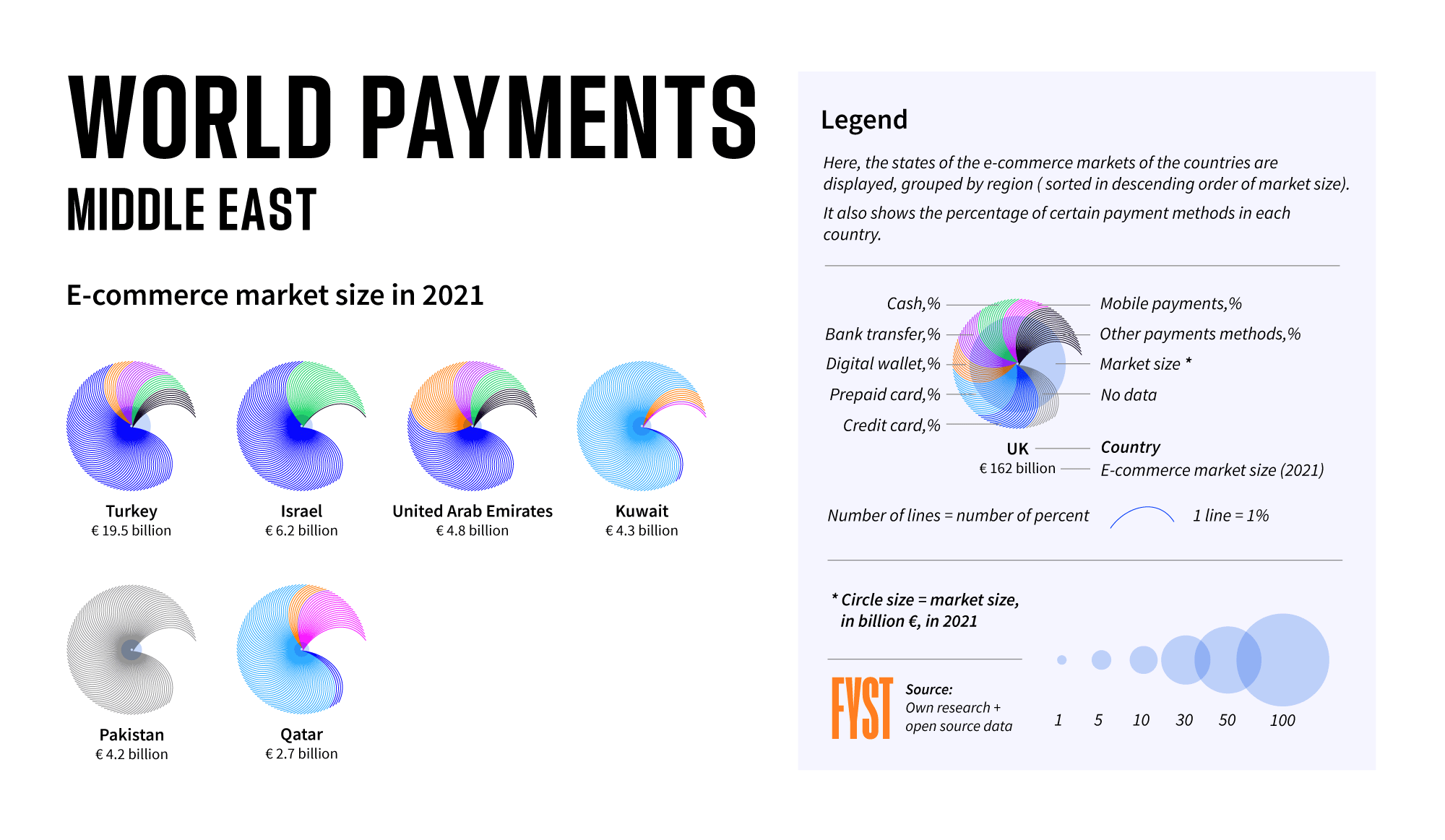

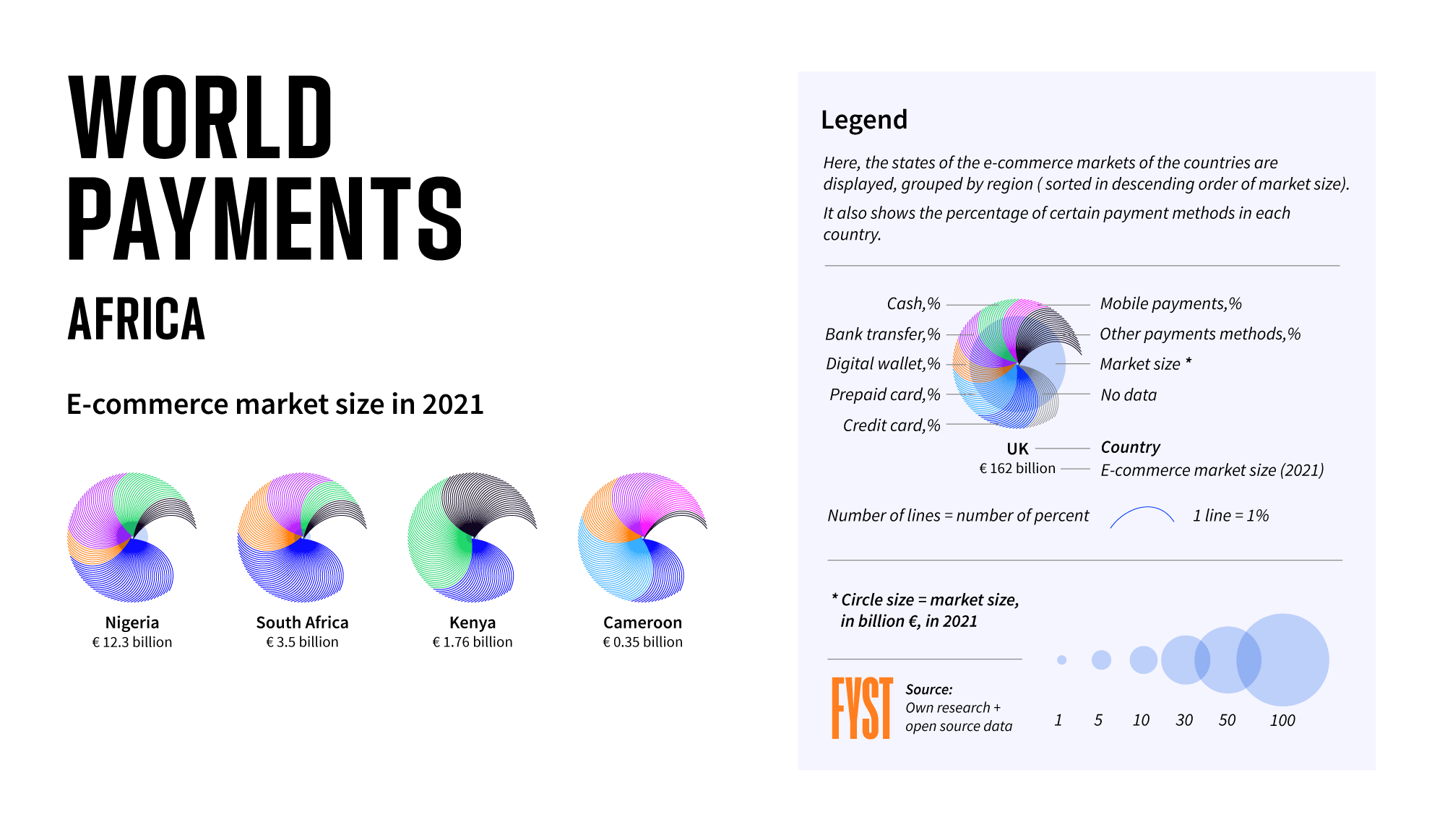

FYST’s exclusive proprietary data, gathered across 10 countries (Turkey, Israel, Qatar, Kuwait, United Arab Emirates, Pakistan, South Africa, Nigeria, Cameroon, and Kenya) shines a light on the proportion of cards, bank transfers, digital wallets and other methods used for online purchases in each country. Crucially, we also outline which payment methods and card types are used in each country, demonstrating how important it is for merchants to be able to accept a wide array of locally-used payment methods to maximise transaction conversion rates and boost revenues.

In the MENA region, credit cards are the most widely used online payment method across the MENA region, followed by bank transfers and cash-on-delivery. But with digital wallets gaining in popularity, and currently making up around 20% of online spending, we can expect to see their usage quickly catch up to and overtake credit cards over the next few years.

For instance, in Turkey, smartphone penetration was around 70% in 2021, and nearly 70% of ecommerce purchases in 2021 were conducted via mobile apps. Turkey’s ecommerce market is currently growing at around 25% annually. The domestic card payment scheme TROY is widely used alongside Visa and Mastercard for online transactions.

In Israel, around 70% of online merchants accept digital wallets, while BNPL/instalment payments are now comprising around 30% of online transaction value. However, in Kuwait, although ecommerce usage is growing, currently most Kuwaiti companies don’t sell online to consumers. The majority of ecommerce transactions are made through cash-on-delivery.

In the wider Africa continent, payment evolution has been defined by mobile-based money transfer services, helping vast swathes of underbanked people across Africa to access digital financial services. Initially offered as remittance services conducted via mobile phones, many of these services have since grown to encompass more value-added services and resembling fully-fledged digital wallets.

South Africa’s ecommerce market is characterised by high usage of debit cards for online purchases, followed by bank transfers, although digital wallets are catching up quickly. In Nigeria, the number of online shoppers is expected to hit 122.5 million by 2025, from 76.7 million in 2021. Digital wallets are expected to double their ecommerce market share to over 15% by 2025.

In contrast, Cameroon’s internet penetration rate is only 35%, making it one of the least-developed ecommerce markets in Africa, but with 47% smartphone penetration, there is a huge opportunity for merchants to tap into fast-growing mobile commerce demand.

These variances outlined in FYST’s whitepaper show how important it is for merchants to add localised payment methods, local currencies, and tailor payment acceptance strategies carefully to each market. By doing so, merchants can capture and convert more transactions, and reduce cart abandonment rates caused by consumers’ preferred payment method not being available.

Turkey

Ecommerce market size in 2021: € 19.5 billion

Card - 67%

Bank transfer - 12%

Cash - 7%

Digital wallet - 6%

Other - 8%

Cards accepted: TROY, Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, Discover, Diners Club, UnionPay, JCB, AstroPay

Bank transfers: local bank transfers, CashU, Mefete

Digital wallets: BKM Express, TROY, Papara, Pep e, Garanti BBVA Mobile, BonusPay, PayFix, fastPay, iPara, WeChat Pay, Alipay

Mobile carrier billing: Paycell

Cash vouchers: Aninda Havale

- With an ecommerce growth rate of 25% annually, credit cards are by far the most popular form of online payment method, outstripping all other methods to comprise 60% of ecommerce expenditure.

- There are over 150 million debit cards and 80 million credit cards in circulation in Turkey, with The domestic card payment scheme TROY is widely used alongside Visa and Mastercard for online transactions. There were 12 million TROY cards in circulation in 2021, which can also be stored in digital wallets.

- Smartphone penetration was around 70% in 2021, and nearly 70% of ecommerce purchases in 2021 were conducted via mobile apps.

Israel

Ecommerce market size in 2021: € 6.2 billion

Credit card - 73%

Digital wallet - 26%

Other - 1%

Cards accepted: Isracard, ICC-CAL, Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, Discover, Diners Club, UnionPay

Bank transfers: local bank transfers

Digital wallets: PayPal, Apple Pay, Google Wallet, PayPal, WeChat Pay, Alipay

BNPL: Sunbit, Splitit, ChargeAfter

- With expected ecommerce market growth of nearly 50% by 2025 to reach over US$12 billion, and over 70% of the population shopping online regularly, Israel’s ecommerce users are avid credit card users.

- The domestic card brand Isracard is widely used alongside Visa and Mastercard and can be co-branded with the international schemes. Isracard comprises around 20% of online transactions in Israel.

- Around 70% of online merchants accept digital wallets, while BNPL/installment payments are beginning to comprise around 30% of online transaction value.

Qatar

Ecommerce market size in 2021: € 2.7 billion

Credit card - 4%

Prepaid card - 70%

Mobile payments - 19%

Bank transfer - 1%

Digital wallet - 6%

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, Discover, Diners Club, UnionPay, JCB, OneCard, KNET

Bank transfers: local bank transfers

Digital wallets: CashU, Apple Pay, Google Wallet, Samsung Pay, PayPal, WeChat Pay, Alipay

- Around 90% of Qatari consumers regularly shop online. Local Qatari online merchants comprise around 40% of online transaction value, with foreign sellers taking the remaining 60%.

- The value of ecommerce transactions is expected to rise by around 150% by 2025.

- Currently, most ecommerce transactions are made through cash-on-delivery, which account for around 70% of online spending, followed by credit cards and digital wallets, although the share of digital wallets and BNPL is set to rise rapidly over the next few years.

Kuwait

Ecommerce market size in 2021: € 4.3 billion

Credit card - 2%

Prepaid card - 90%

Mobile payments - 1%

Bank transfer - 1%

Digital wallet - 6%

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, Discover, Diners Club, UnionPay, JCB, OneCard, KNET

Bank transfers: local bank transfers

Digital wallets: CashU, Apple Pay, Google Wallet, Samsung Pay, PayPal, WeChat Pay, Alipay

Cash-on-delivery: SIVVI

- Around 2 million people in Kuwait, 50% of the population, shop online regularly. Kuwait’s ecommerce market is expected to grow by around 15% by 2025.

- Although ecommerce usage is growing, currently most Kuwaiti companies don’t sell online to consumers. The majority of ecommerce transactions are made through cash-on-delivery.

United Arab Emirates

Ecommerce market size in 2021: € 4.8 billion

Card - 48%

Bank transfer - 11%

Cash - 10%

Digital wallet - 23%

Other - 8%

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, Discover, Diners Club, UnionPay, JCB, OneCard, Mercury

Bank transfers: MBME, local bank transfers

Digital wallets: KLIP, 7-Eleven, Nol, Apple Pay, Google Wallet, Samsung Pay, PayPal, WeChat Pay, Alipay

- Around 30% of consumers in the UAE make an ecommerce transaction via smartphone at least once a week.

- The mobile commerce markets was worth US$ 2.6 billion in 2021, comprising around 45% of the overall ecommerce market value.

- Online shoppers in the UAE prefer to buy from Kuwaiti online businesses, with domestic ecommerce websites comprising over 70% of total sales.

Pakistan

Ecommerce market size in 2021: € 4.2 billion

Cards accepted: Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, Discover, Diners Club, UnionPay, JCB

FYST data shows that bank transfers, demand drafts, EasyPaisa, JazzCash, Upaisa, Payoneer, GoLootLO, PayPak, MoneyGram, Western Union, Ria Money Transfer, HBL-Konnect, Keenu Wallet, FonePay, PayMax, Konnect, UBL Omni, Mobicash, and Huawei Pay are some of the widely used online payment methods in Pakistan.

- Pakistan is one of Asia’a under-developed ecommerce markets, around 70% of the 200 million-strong population is classed as unbanked, with ecommerce representing just 1.5% of overall retail sales.

- Around 95% of online companies accept cash-on-delivery for online orders, and cash-on-delivery accounts for 60% of ecommerce expenditure in Pakistan.

- The number of registered ecommerce merchants in Pakistan stood at over 3,000 in 2021.

South Africa

Ecommerce market size in 2021: € 3.5 billion

Card - 44%

Bank transfer - 19%

Cash - 10%

Digital wallet - 19%

Other - 8%

Cards accepted: UnionPay, Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, UnionPay, JCB, Diners Club, Discover

Transfer services: local bank transfers, SiB Instant EFT, Neteller

Digital wallets: Apple Pay, Google Wallet, Samsung Pay, PayPal, WeChat Pay, Alipay, Skrill, Snapscan, FNB CellPayPoint, Mobicash, PayD, M-Pesa, Avo

Mobile carrier billing: MTN, Mobicred, Boku, Airtel

- Debit cards are widely used for online purchases in South Africa, followed by bank transfers, although digital wallets are catching up quickly.

- Total online sales in 2020 increased by 55%, and by 42% in 2021, driven by fast-rising spending in less traditional ecommerce sectors outside of consumer goods.

- Around 70% of South African consumers shop online at least once a month, indicating an opportunity for major growth in ecommerce.

Nigeria

Ecommerce market size in 2021: € 12.3 billion

Card - 37%

Bank transfer - 26%

Cash - 20%

Digital wallet - 8%

Other - 9%

Cards accepted: Verve, UnionPay, Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, UnionPay, JCB, Diners Club, Discover, ecoPayz, Paysafecard

Transfer services: local bank transfers, AstroPay, BankIT, Neteller

Digital wallets: Apple Pay, Google Wallet, Samsung Pay, PayPal, WeChat Pay, Alipay, Skrill, PalmPay, JumiaPay, Konga Pay, Pocket Money, Readicash, Paga Wallet

Mobile carrier billing: Boku, Airtel, Quickteller, MTN

- Nigeria is one of Africa’s most exciting ecommerce markets, and is expected to record strong double-digit growth rates by 2025. Cards accepted: UnionPay, Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, UnionPay, JCB, Diners Club, Discover

- Bank transfers currently form most ecommerce transactions value, while cash-on-delivery is trusted by the large unbanked population.

- The number of online shoppers in Nigeria is expected to hit 122.5 million by 2025, from 76.7 million in 2021. Digital wallets are expected to double their ecommerce market share to over 15% by 2025.

Cameroon

Ecommerce market size in 2021: € 353 million

Credit card - 16%

Prepaid card - 33%

Mobile payments - 16%

Bank transfer - 16%

Digital wallet - 16%

Other - 3%

Cards accepted: UnionPay, Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, UnionPay

Transfer services: local bank transfers

Digital wallets: PayPal, WeChat Pay, Alipay, Orange Money, MTN Mobile Money

Mobile carrier billing: MTN

- With an internet penetration rate of only 35%, Cameroon is one of the least-developed ecommerce markets in Africa, but one with enormous potential thanks to 47% smartphone penetration, a figure which is rapidly rising.

- Prepaid cards are more widely used than bank credit or debit cards, due to the lack of formal banking infrastructure in Cameroon.

Kenya

Ecommerce market size in 2021: € 1.76 billion

Card - 25%

Cash - 40%

Other - 35%

Cards accepted: Verve UnionPay, Mastercard, Visa, Debit Mastercard, Visa Debit, American Express, UnionPay

Transfer services: local bank transfers, JumiaPay, PesaLink

Digital wallets: PayPal, WeChat Pay, Alipay, Orange Money, MTN Mobile Money, PayU, M-Pesa, Mobicash

Mobile carrier billing: MTN, Airtel

- Kenya’s ecommerce market is largely driven by the 70% of Kenyans who use mobile money services.

Conclusion – the importance of localising payments by market

What’s most important for merchants when they’re trying to grow? Is it offering the widest product range at the lowest prices? Or having the most eye-catching advertising campaign? Merchants often forget to put themselves in their customers’ shoes, especially those entering the site for the first time. What do customer see? How easy is it for them to find what they’re looking for? And can they pay in the way they want to pay?

The global ecommerce landscape is getting more crowded and brutally competitive, and consumers are more impatient and demanding than ever before. The breakneck pace of payment technology innovation is putting even more pressure on merchants to offer their customers even quicker and easier payment journeys. It’s easy to forget just how much work goes on behind the scenes to get a fast checkout process in place – and the challenges of slashing the dreaded cart abandonment rate are even harder when trying to sell to international customers.

In summary:

- Adding localised payment methods, local currencies and optimising the payment funnel are no-brainers when trying to grow cross-border ecommerce sales. Putting these in place will undoubtedly help to attract customers and raise checkout conversions.

- As cross-border payments get more complex, it’s not just consumers who need payments to be made as simple as possible at the checkout stage. Merchants too need to have payment gateways and platforms that are easy to use and simple for them to navigate, so they can give their customers the best experience possible.

- Merchants are becoming fed up with having to work with multiple acquirers and platforms for different types of transactions or services. Merchants want everything run through a single, easy to use platform, enabling them to accept localised payment methods, offering a transparent view of all data.

All of these elements give merchants the 360-degree overview of customer behaviour they need to fine-tune their businesses, strengthen their revenue streams, and reach far into new markets and customer bases.

At FYST, we have one clear mission - by removing geographical limitations and simplifying complex processes, we enable businesses in all sectors to navigate the fast-growing cross-border ecommerce market.

Simply put, FYST is a one-stop payments consultancy for ecommerce businesses, empowering merchants with a unique mix of agile digital payments capabilities, unrivalled personalised support, and compliance and AML advisory services.

If you want to find out how to optimise your online presence and unlock game-changing payment method acceptance, contact FYST today.